Knight Frank released their new report exploring the floor level premium in London’s high-rise residential developments with the coolest report name ever: Knight Frank Tall Towers Report 2012

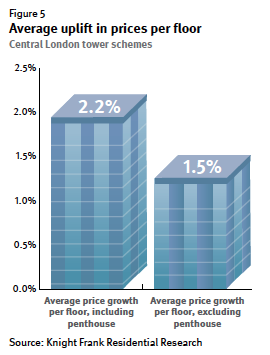

While NYC has a taller residential housing stock than London but the premium per floor is similar. London shows a 1.5% increase in value per floor. My rule of thumb for Manhattan has been 1% to 1.5%, but closer to 1%. However we treat floor level as a different amenity than view and that’s probably the reason for the slightly larger adjustment in London. What’s particularly of interest is how much more the per floor cost of development is for higher floors:

Net to gross area ratios in tower schemes

are lower, since the percentage of space

taken up by the cores and service provision

areas are comparatively high. This means

that the effective revenue-generating

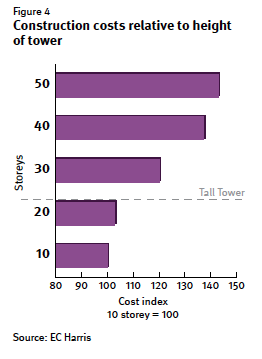

43% Uplift in construction costs per sq ft

between the 10th and 50th floor.

I’ve explored the subject myself in New York Magazine and The Real Deal Magazine.

_________________

Tall Towers Report 2012 [Knight Frank] Manhattan Values By Floor Level [Matrix/New York Magazine] The cost of a view [The Real Deal]