The controversy remains with all of us, just like the Fed's inability to stray from their inability to cut rates as the economy roars ahead, inflation threatens, insurance and property taxes are rising so the housing market suffers like Times New Roman. The controversy is real. Ok, not really, but when can we ever have a discussion about fonts? Did you miss last Friday's Housing Notes? April 12...

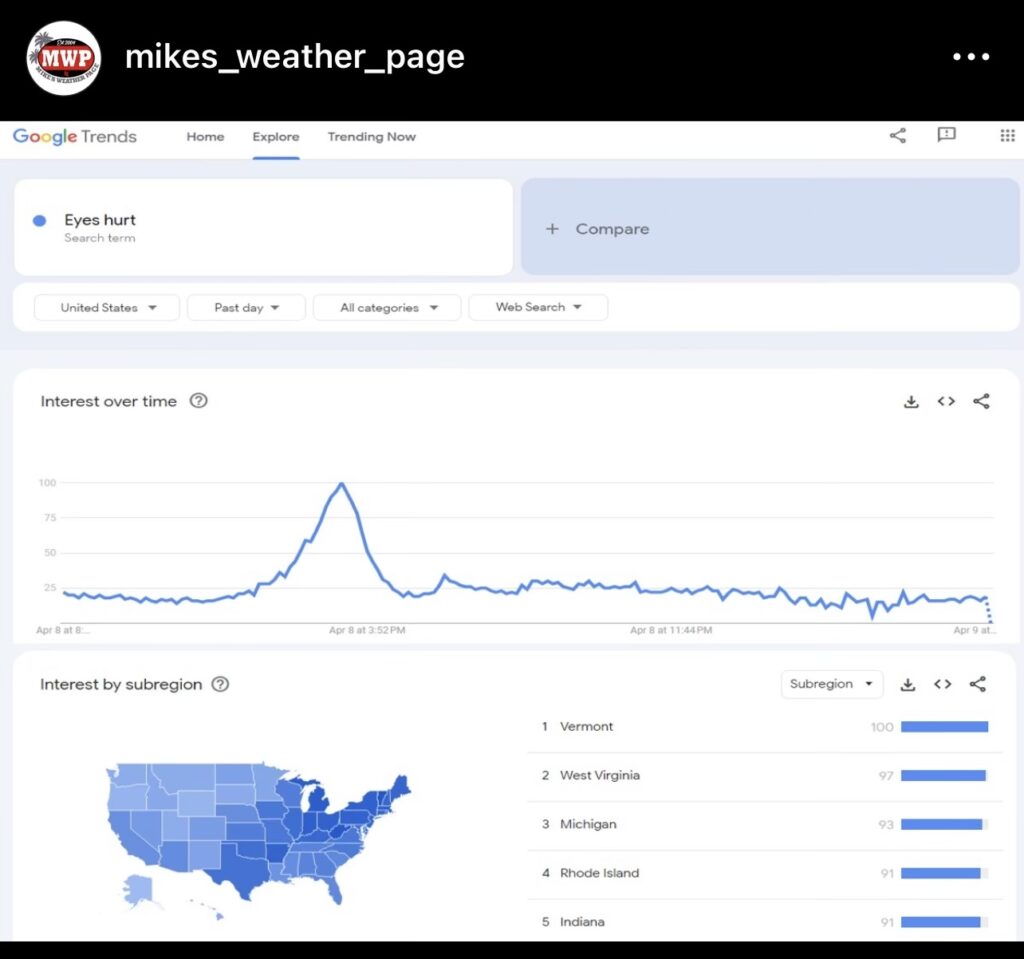

Our Eyes Hurt After Watching Mortgage Rates Eclipse Our Expectations For Cicadas

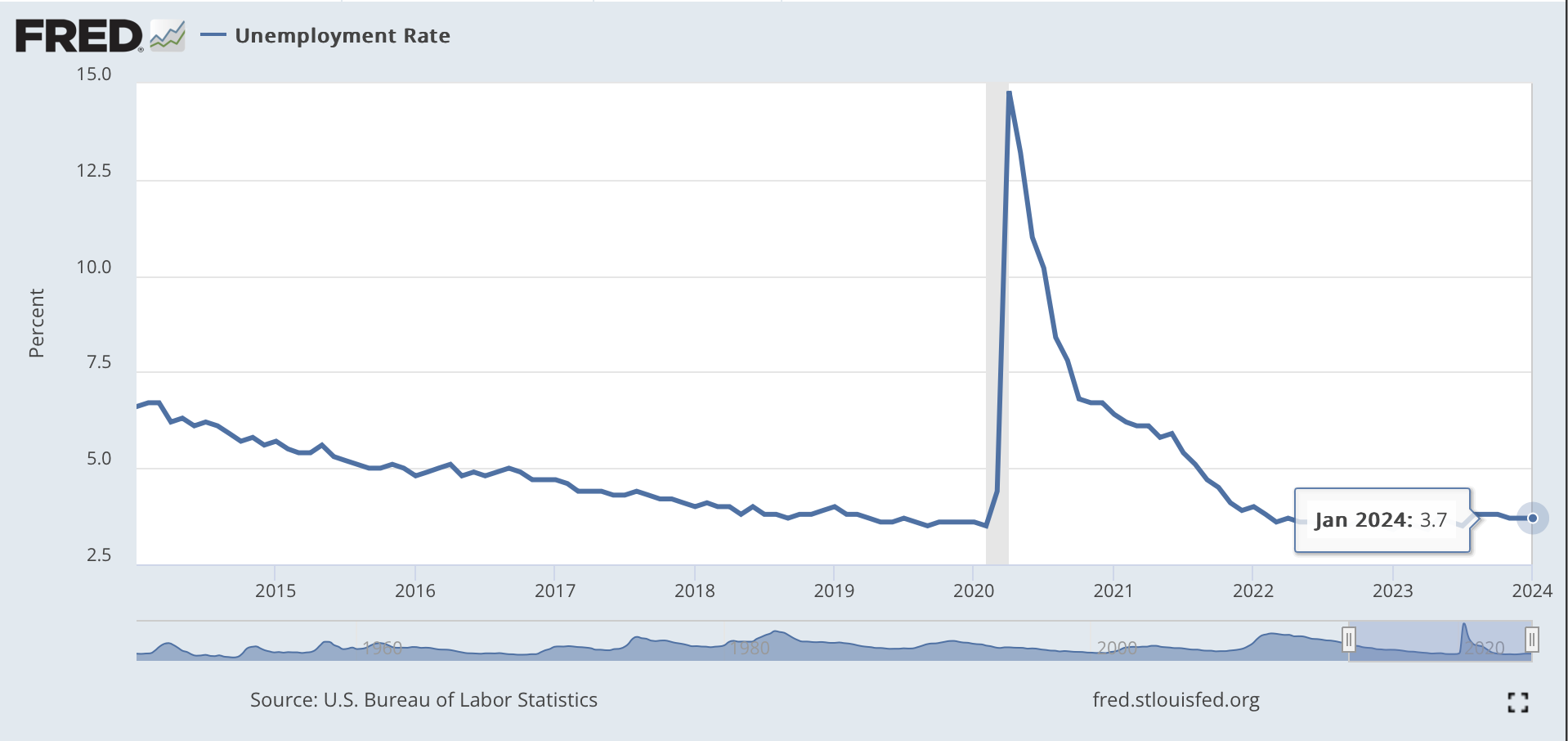

Curiously, some perceive the economy's vibes as terrible, but this @$#^& economy is outperforming expectations with the lowest unemployment in nearly 50 years and rising wages—perfect conditions for a housing boom except for the rising homeownership costs, dearth of listing inventory (even as it rises), and the cicada apocalypse. The following chart is a reminder of how people handled...

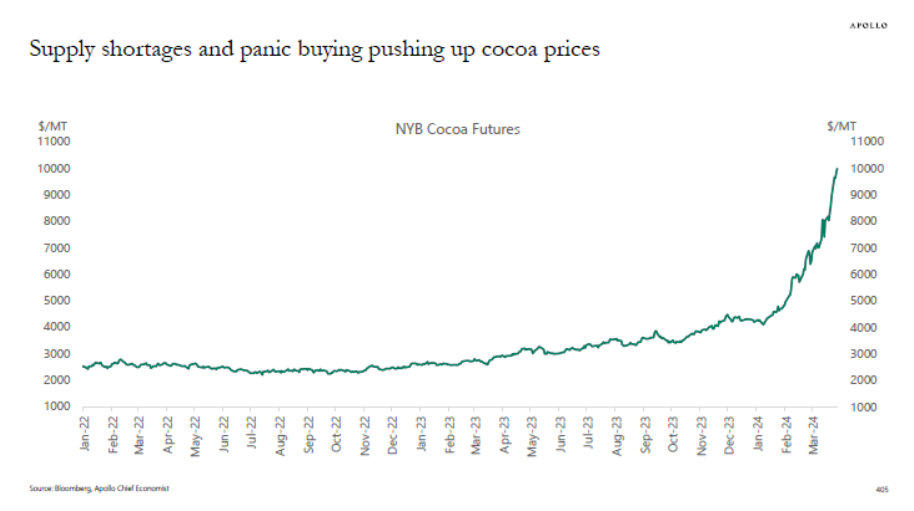

Chocolate Costs Are Sort Of About To Eclipse The Housing Crisis

Cocoa faces challenges similar to housing in this excellent JPMorgan research paper on the causes of the chocolate crisis: climate change, lack of investment, limited supply, and shrinkflation. Also, consider the cost of lodging in the best places to view the eclipse on Monday. Consider what can be learned from different statistical interpretations of climate change: Or the economic signs...

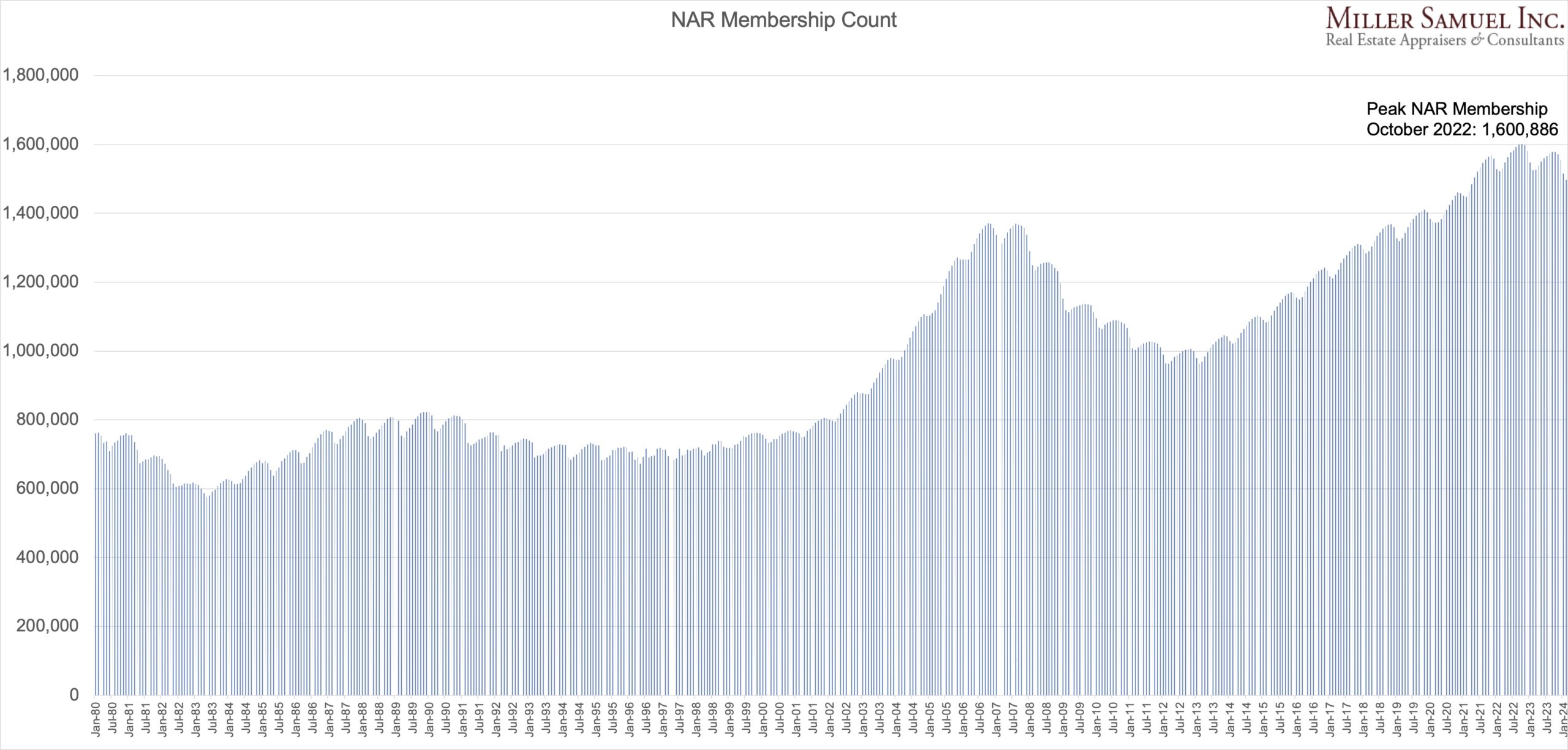

The Future of Real Estate Brokerage That Once Had Its Max Headroom

But now, the industry and the housing market are in a perfect storm, and the keyword is confusion. Buyer's agents are the vulnerable party, and robust employment and wage growth are making us wonder about those Fed rate cuts in the back half of this year. I have always marveled at this 1980s meme on steroids. Max Headroom was everywhere overnight, then quickly, almost nowhere. Now think about...

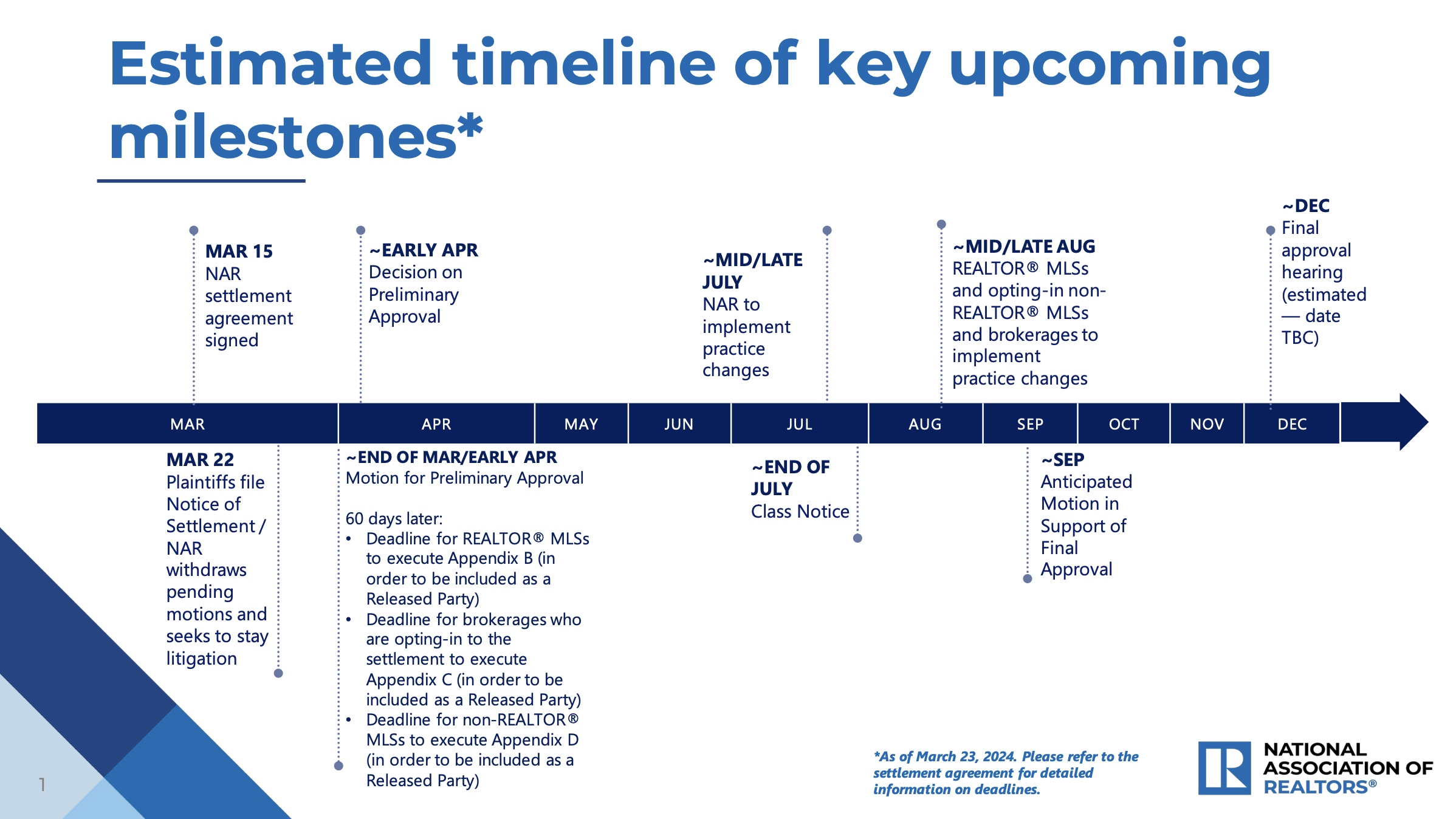

The NAR Settlement Makes Housing Market Uncertainty Go To Eleven

The purpose of NAR's landmark settlement was to decouple the commissions paid by the seller from the buyer's agent. After all, sellers don't hire the buyer's agent, nor does the buyer's agent act in the seller's best interests. The settlement means that users of representation services must pay for those services. In a traditional deal structure, the listing agent was usually paid 6% and gave 3%...

The Housing Market Is Like [Insert Analogy]

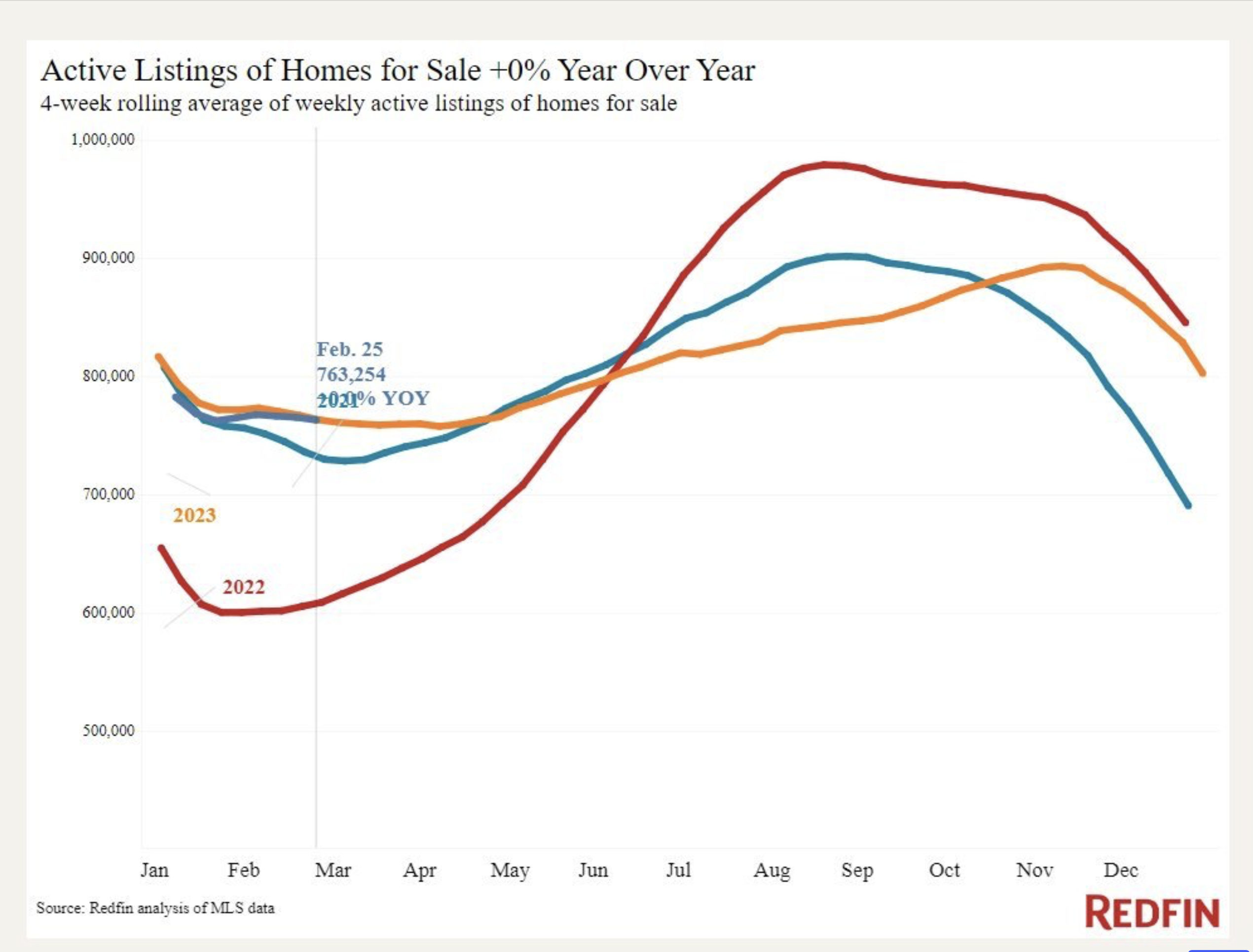

Over the past month, mortgage rates have slowly risen as the economy remains stubbornly like a rocket ship. As a baseline, low unemployment and higher wages are like a good foundation for a new house except for rising mortgage rates, which is the opposite of the smaller size trend of new homes to enable buyers to grapple with falling affordability since finding a listing is like finding a needle...

Like The Housing Market, No One Should Put Ketchup On A Hot Dog

Listing inventory is finally beginning to enter the market at scale as newly signed contracts expand. Some truths can't be explained away, and those 30 percenters are simply wrong. Did you miss last Friday's Housing Notes? March 1, 2024: Is The Housing Market OK? But I digress... New York Metro, Florida, and So Cal Area New Signed Contracts Are Up, And So Are New Listings I've been the author of...

Is The Housing Market OK?

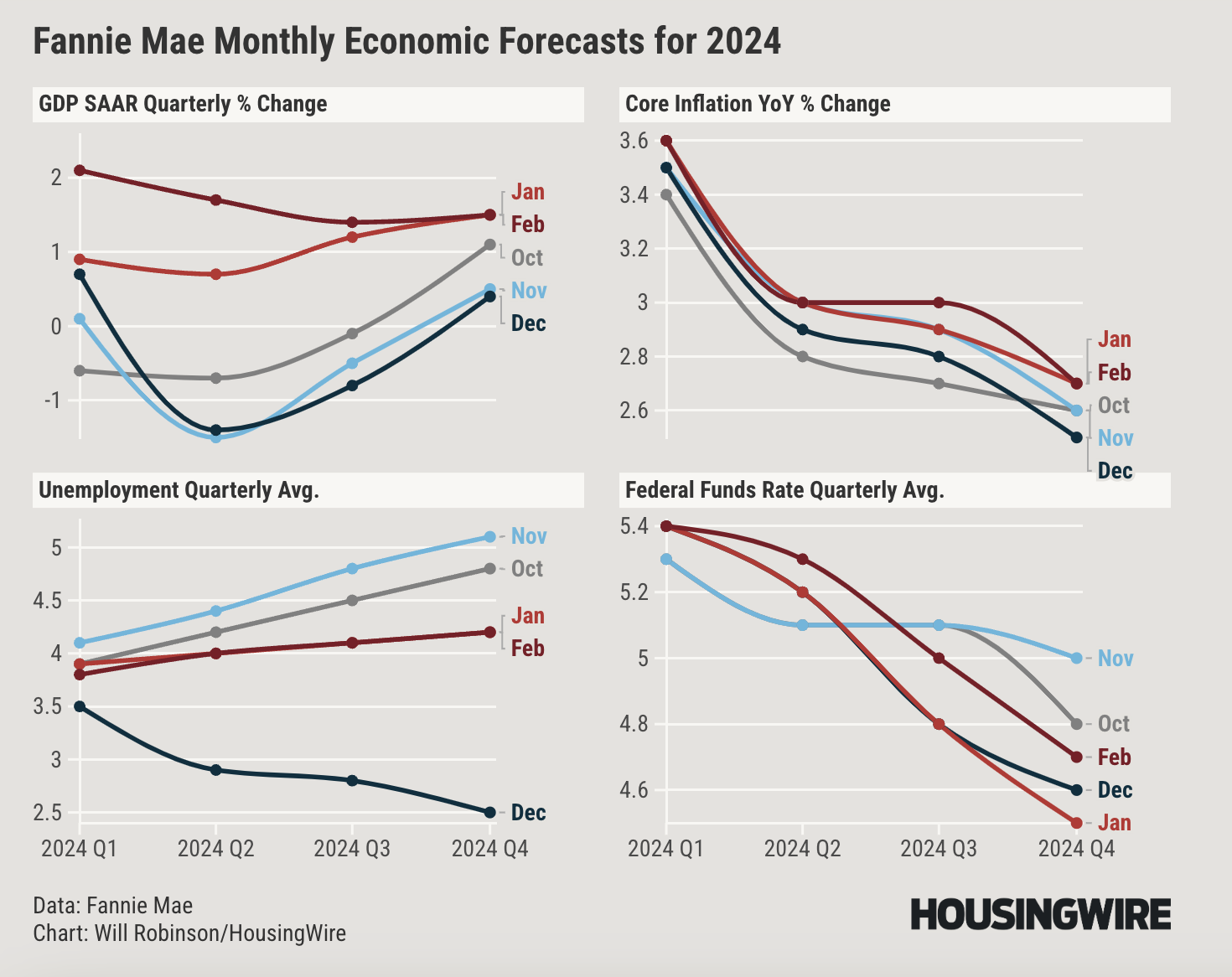

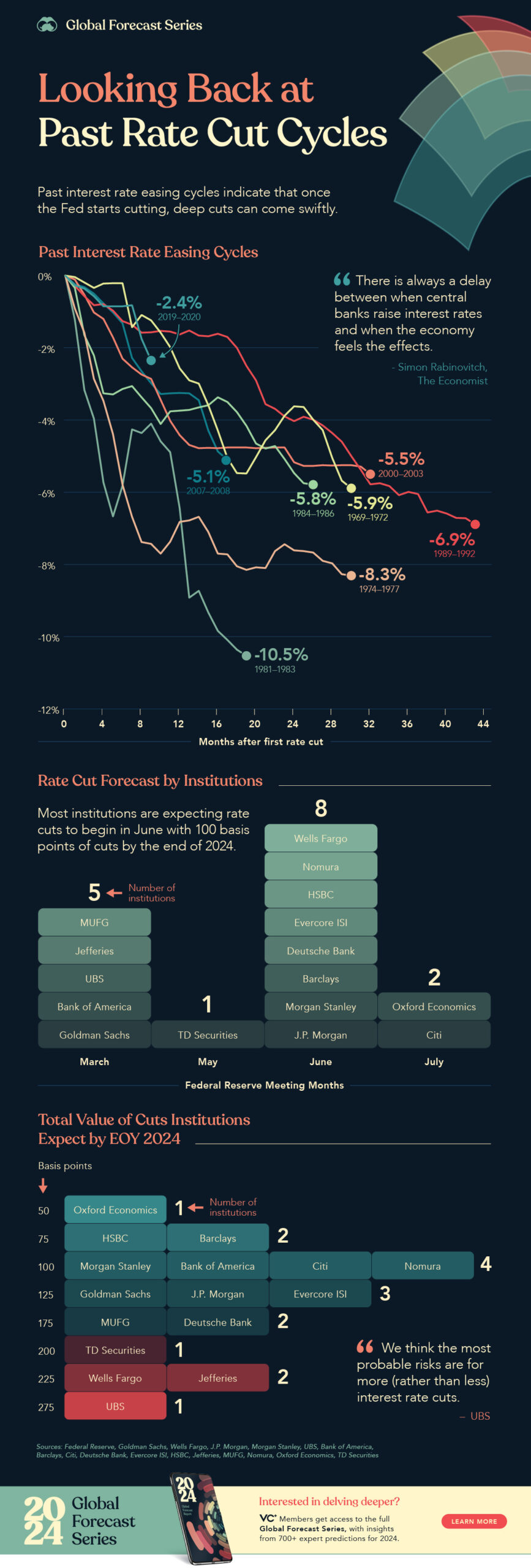

The two questions that dominate the housing market industry continue to be either: Q1: When will the Fed cut interest rates? A1: Back Half of 2024? My wild guess is that rate cuts will be in the back half of 2024. Not in March. Not in June. Unemployment is way too low. In reality, you probably shouldn't listen to me. Here's an historical look at how quickly those cuts occur. Q2: When will NAR...

The Housing Market Needs More Cowbell (Lower Rates)

The economy continues to remain strong, with unemployment staying below 4%. While housing sales remain weak, there are recent signs of expanded new signed contract activity, a product of a strong economy and the notion that buyers might be able to refi out lower over the next few years. The housing market has been punished harder than most other sectors with the rapid gain in interest rates over...

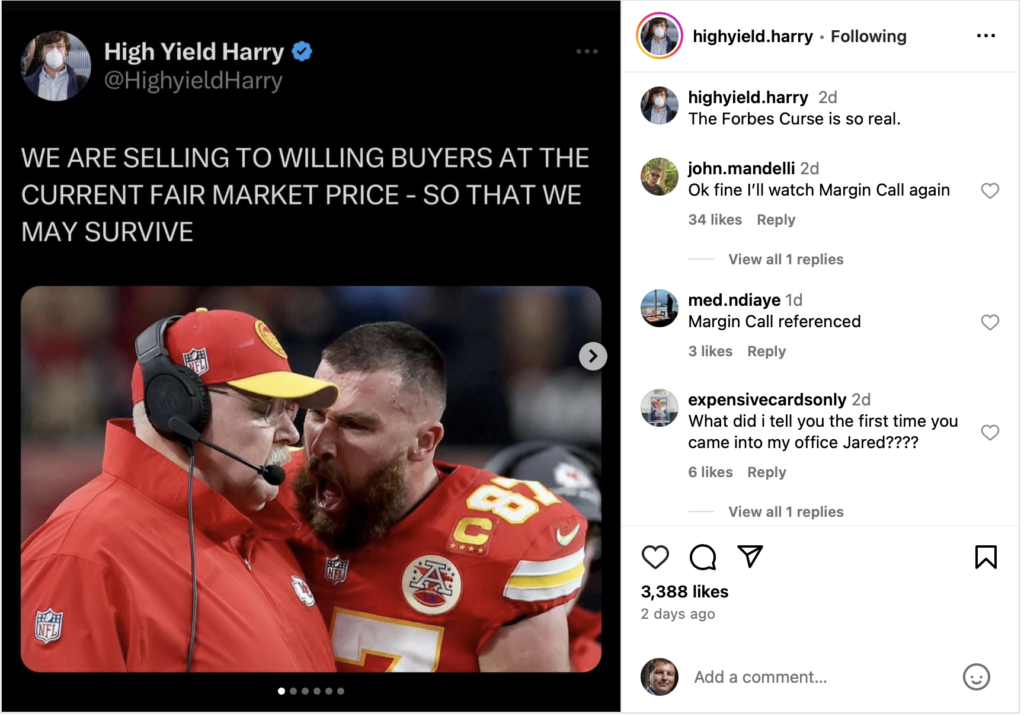

Post-Super Bowl Housing Market Taylored For Swifter Conditions

The back half of 2024 continues to look better for housing transaction volume with eventual rate cuts, combined with low unemployment. The Chief's Justin Watson should be nominated as the next Fed chair! Did you miss last Friday's Housing Notes? February 8, 2024 Housing Numbers Are Still More Powerful Than Its Letters Or Symbols But I digress... The San Francisco And Kansas City Housing Markets...

![[27 Speaks Podcast] Jonathan Miller Provides A 2024 Hamptons Outlook](https://millersamuel.com/files/2024/02/27eastlogo-600x314.jpg)