At Matrix, I have been following the [CME Housing Indexes](http://matrix.millersamuelv2.wpenginepowered.com/?cat=54) that are based on the work of the noted economist Robert Shiller and others. Bob has been discussing this in various venues around the country as a way for the investors to hedge their bets.

In [Days of Housing Futures Past [TheStreet.com]](http://www.thestreet.com/_tscs/newsanalysis/optionsfutures/10297288.html) Howard Simons makes the case that these housing contracts, _based on ‘old’ data and with sizable size issues, aren’t such a good idea._ Its a really well thought out article.

Here’s why:

* Past performance may not predict future results

* All futures markets are based on the principle of indifference.

* Futures markets also have a large measure of insurance built into them.

>This is not the case with housing futures. Each of the contracts is based on the S&P/Case-Shiller (CSI) home price indices. They cover metropolitan areas of Boston, Miami, New York, San Diego, San Francisco, Washington, D.C., Chicago, Las Vegas, Denver and Los Angeles, as well as a composite national index. That in itself does not present a problem; we have close to 25 years of experience trading index-based, cash-settled futures on things such as stock indices.

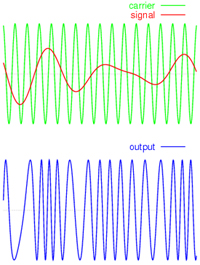

Frequency is the problem:

>Unlike a stock index that is refreshed several times a minute, the CSI indices are released at 1:15 p.m. Central Standard Time on the last Tuesday of every calendar month. The release is of necessity for data collected for previous months. For example, the August report will cover the data collected for April, May and June in each reporting region.

_Housing futures are being marketed as an indirect way of playing rising long-term interest rates. The answer is simple: If you think rates are going higher, sell bond futures or something similar. They are a direct play on interest rates._

The basic premise of the author is that housing futures are really not a play on the future, but rather a play on the past since the basis for the index is relatively dated by the time its used. The low volume of home sales tracked in the index also make it less reliable.

[Perhaps we should hedge our bets on cheddar cheese and non-fat dry milk instead [Matrix]](http://matrix.millersamuelv2.wpenginepowered.com/?p=501)?3 Comments

Comments are closed.

TheStreet.com’s article was accurate in so far as that if the CME listed only a spot futures contract, then yes, all you are doing is number gaming an event (the yet to be calculated index value)that has already occurred. The CME in fact lists out to May 2007. This allows a trader to transfer housing price risk on an event which has not yet occurred (the Q1 2007 cash housing trades). When the CME lists multiyear futures for the housing indexes, then the market will most certainly be looking forward with an index that looks back 2 months at settlement.

“The low volume of home sales tracked in the index also make it less reliable.”

Low volume of home sales?? Reality check: Each month’s S&P/Case-Shiller Home Price Indices are based upon very large, representative sale pair counts – 2,500 to 12,000 is typical, depending upon metro area.

Terry – I am referring to the number of futures traded, not the index.