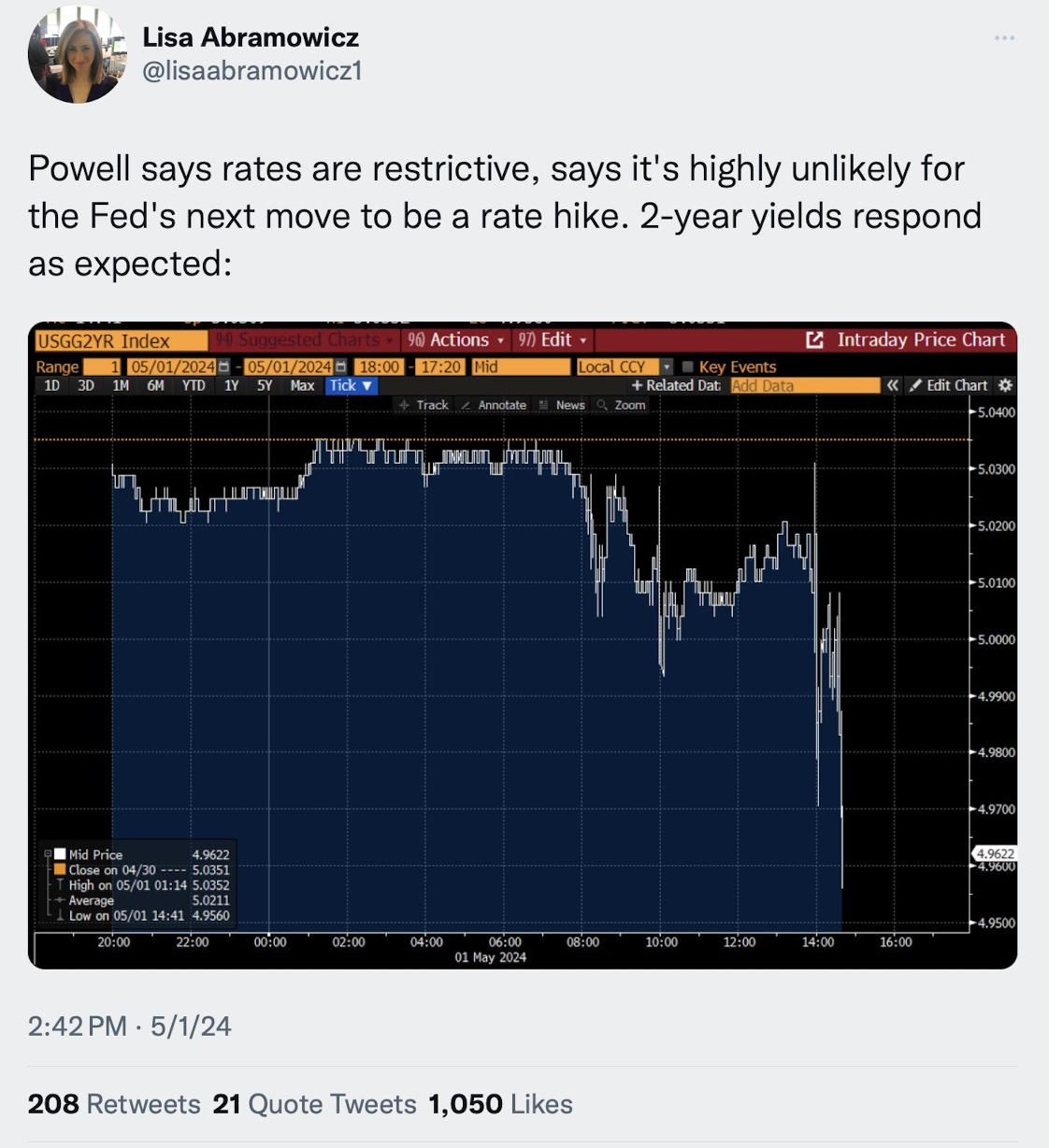

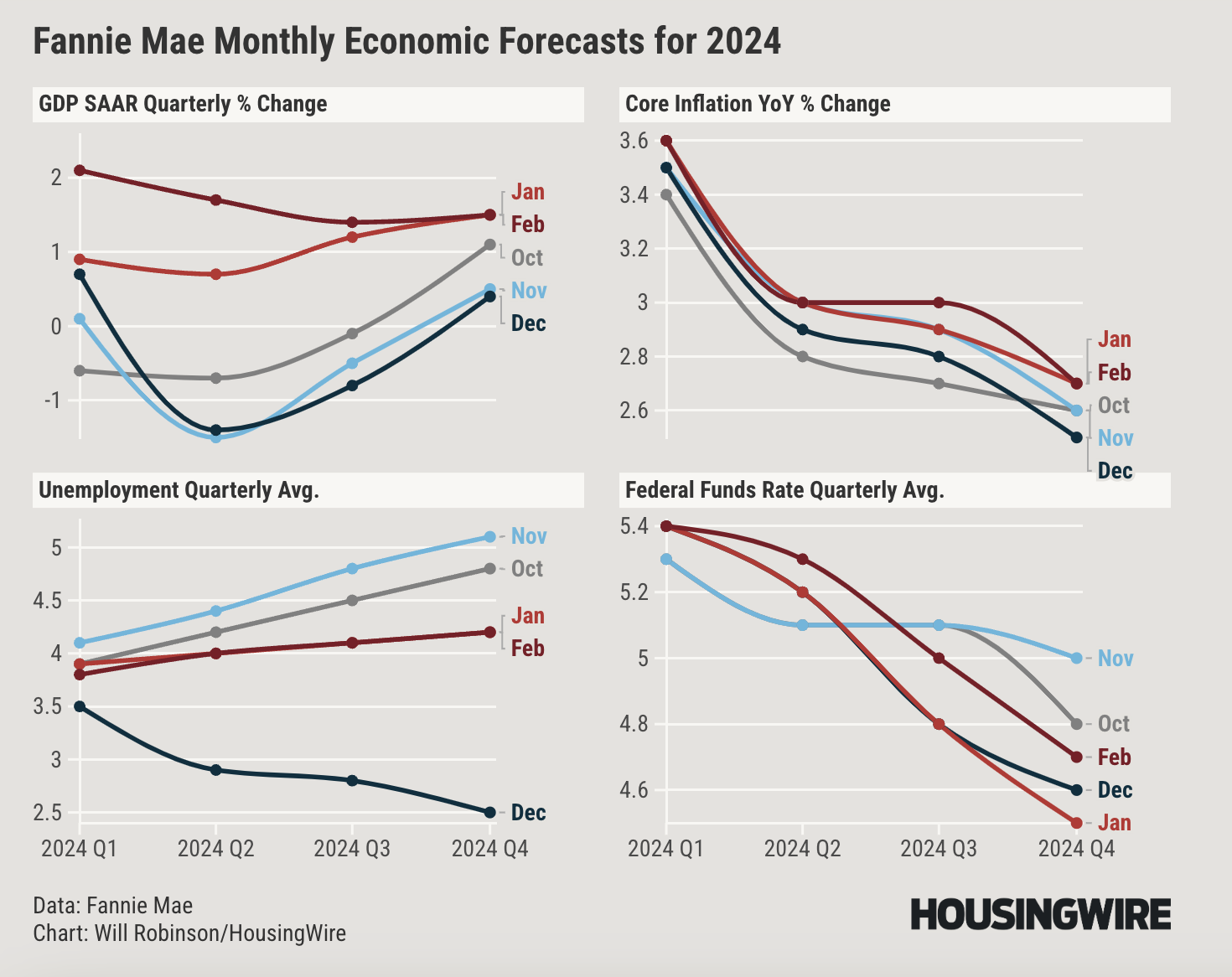

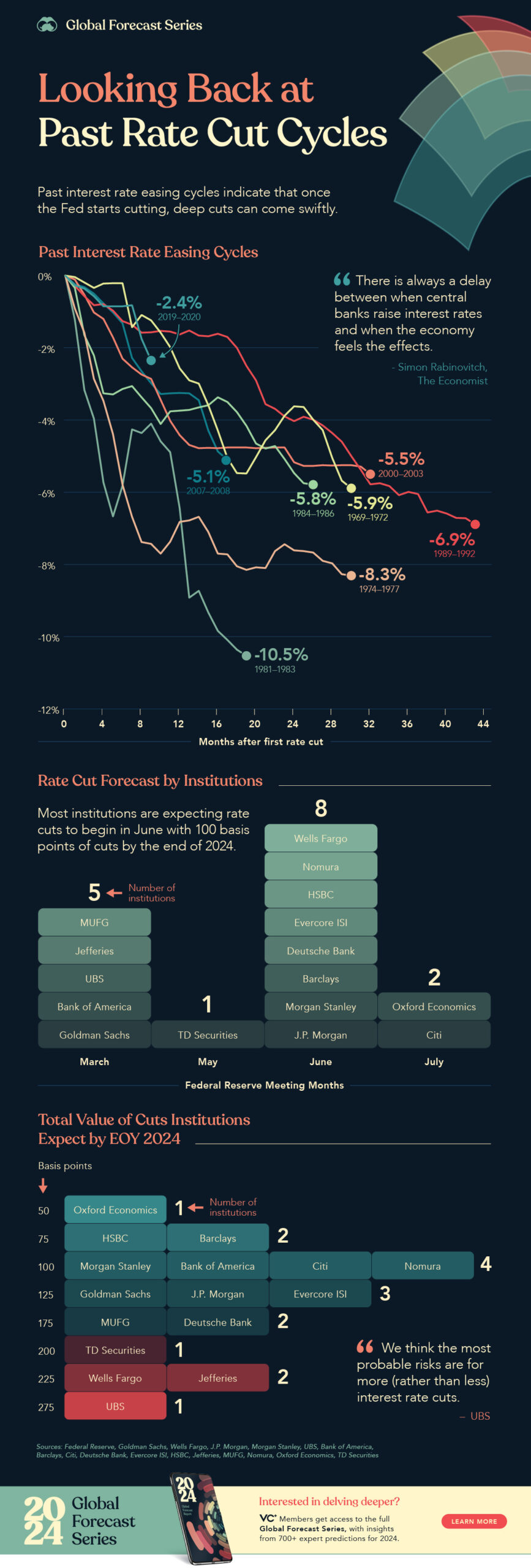

Observers are buzzing that the labor market is cooling, with job openings and quits on the decline, and the Fed Chair says rates are still restrictive. Still, the phrase 'higher for longer' makes housing professionals weep. Thankfully, the Fed kept rates steady. My friend Barry Ritholtz has a mega post with charts galore on why the Fed should actually be cutting already. See what everyone is...

![[27 Speaks Podcast] Jonathan Miller Provides A 2024 Hamptons Outlook](https://millersamuel.com/files/2024/02/27eastlogo-600x314.jpg)