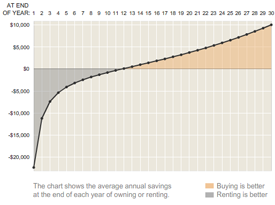

The front page story in the New York Times yesterday, featured a story written by one of my favorite economics writers, David Leonhardt, called A Word of Advice During a Housing Slump: Rent. He explores the rent versus buy dilemma at length in the article. In addition, the article links to the best rent versus buy tool I have ever come across.

The NAR is promoting the current market as a great opportunity to purchase because mortgage rates are low. However…

>Over the next five years, which is about the average amount of time recent buyers have remained in their homes, prices in the Los Angeles area would have to rise more than 5 percent a year for a typical buyer there to do better than a renter. The same is true in Phoenix, Las Vegas, the New York region, Northern California and South Florida. In the Boston and Washington areas, the break-even point is about 4 percent.

The impact on prices and affordability is much more dramatic than a change in mortgage rates. Add to this, tightening credit and it appears that prices would need to correct in many parts of the country before the housing market comes back. And by coming back, I would measure this by a noticeable increase in the number of transactions.

>“House prices have to fall more before housing becomes a clear buy again,” says Mark Zandi, chief economist of Moody’s Economy.com, a research company that helped conduct the analysis. “These markets aren’t as overvalued as they were a year ago or two years ago, but they’re still unfriendly. And that’s one of the reasons the market is still soft — people realize it’s not a bargain.”

[As far as New York goes, the analysis concluded the buy side was favored](http://www.nytimes.com/2007/04/10/realestate/11leonside.html) if the Manhattan co-op example increased 3% per year for the next 5 years and the Westchester county example increased 4% during the same period. Interesting. With inflation at 2-3%, in real dollars, the co-op would would effectively not need to show a gain and the house would need to rise only 5% overall during the five year period.

On the national front, I strongly believe the situation is not as good as NAR paints it (but hey, they are a trade group) and not as dire as economists paint it (hey, they are paid to worry) , but its definitely not good. There will be a lot more painting that needs to be done before this is over.

3 Comments

Comments are closed.

I agree — this is the best buy vs rent tool available on the web. Disappointed with the freely/commercially available tools, I wrote my own using a PHP script in 2005 when the market looked very toppy. I included additional assumptions such as “bubble percentage overvaluation“, and plotted the total inflation-adjusted gain/loss for each decision over a specified period. The numbers were staggering, even for the “rosy” 0% bubble assumption. For the more realistic downside assumptions of a 15-25% bubble correction (followed by slightly better than rate-of-inflation growth), the financial choice was clear: commit to renting for the foreseeable future, and save hundreds of thousands of dollars for my expected situtation.

I’m glad that the NYT is giving easy access to this important financial information — clearly, far too many people were living on real estate myths during the past boom.

However, I think that this tool would have greater impact if they included the total gain/loss for each period — the numbers really are big, which is one reason to factor in the likelihood of a big drop.

You included in your calculator a “bubble percentage over-valuation”???

It sounds as though you built a calculator that fit your belief – that the real estate market was “toppy”.

Other calculators use past behaviors as indicative of future results. What was the inflation rate, what was the average interest rate, how much have rents risen?

Your calculator doesn’t seem very good.

Well, I figure that it’s saved me about $150-200K in lost equity in my local market (so far) had I purchased two or three years ago, so I’m happy with it, but that may be chump change to you. Your mileage may vary if you bought since 2003 or 2004, though the arithmetic is exactly the same, just the emotions are different.

Of course I factored in a “percentage bubble overvaluation”. It’s been obvious to anyone with a mortgage calculator and knowledge of wage history that the recent price runup is unsustainable and has a very high likelihood of correcting, possibly severly. For myself, I cannot afford to lose a down payment or more on a cyclical correction. Not factoring in this downside risk is very dangerous, especially when rents are running at 50-60% of the cost of purchase in my local market.

Finally, the “percentage bubble overvaluation” was a parameter I used to test various scenarios: no bubble (0 to +20% price inflation), mild bubble (0 to -15% price deflation), and severe bubble (-15% to -40% or more price deflation). Sure, it was appealing to leverage a low interest ARM with the hope of a big gain in the no bubble scenario, but the negative leverage of even a mild bubble would wipe me out, leaving me under water. In hindsight, this is exactly what would have happened since I wrote the calculator. That’s why I’m renting for the foreseeable future — the downside risk of buying is still far to high, and the investment return on the difference between my rent and the market prices has been very reasonable. I did test these assumptions and outcomes with a range of expected inflation rates, though focused on the 3% or so we’ve seen and are expected to see unless the Fed decides to inflate us out of our current account deficits.

I’ll poke my head back up after we see if current Wall Street warnings about the $100 billion of likely home loan defaults and/or a recession this year or next appear or not. In the meantime, I gladly hand deliver my rent check to my landlord downstairs.