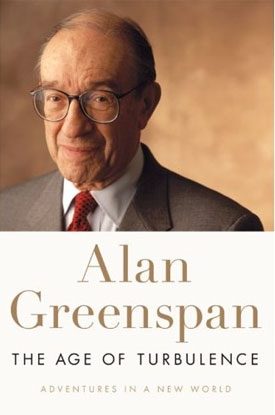

Hey I admit it, I bought the former Fed Chair Greenspan’s new book The Age of Turbulence on Monday, the first day it was available. Of course I bought as a birthday present for me, not to be opened for a few weeks when my maturity age of 17 clashes in screaming technicolor with my actual age, even louder than a rate cut. We have strict rules around my house. If I buy something under the pretense of it being a birthday present, its not to be opened until then.

Well its been a week and I have had some time to reflect on the events associated with the new book, before I have even read it.

What thought first comes to mind? Incredible timing. Who says you can’t time a market?

Announce a book the day before one of the most anticipated FOMC meetings in recent memory, support your successor, admit some flaws but no regrets, criticize the administration as well as both the Democrats and Republicans in Congress, acknowledge a housing market problem but keep your reputation in tact. Hey, the $8M advance needs to be earned.

All this gets you a number one ranking on Amazon.com, ahead of Water for Elephants, Playing for Pizza and Math Doesn’t Suck: How to Survive Middle-School Math Without Losing Your Mind or Breaking a Nail.

Since I admired Greenspan during his tenure, I can’t tell if the insight being provided during the media blitz is helpful in understanding how we got here, or merely spin.

Caroline Baum, one of my favorite columnists on Bloomberg sums it up nicely:

>Greenspan, who reportedly received an advance of more than $8 million for this memoir, seems eager to stave off criticism for keeping short-term rates too low for too long in 2003 and 2004, stoking a housing bubble in the process. He was aware of reduced credit standards on subprime mortgage loans, he says, “but I believed then, as now, that the benefits of broadened home ownership are worth the risk.'”

>That view is being challenged as the housing bubble deflates, delinquencies and foreclosures rise and financial losses mount. The reader is left wondering if a more introspective Greenspan, and one less interested in shaping his legacy, wouldn’t have found a regret or two along the way.

With a possible recession looming and housing on the downslide (a word?), I am experiencing my own personal turbulence and have officially added it to my economic vocabulary in addition to “contained”, “frothy” and “irrational exuberance”.