In Berson’s Weekly Commentary: [Mortgage Debt Outstanding (MDO) growth in 2005 — exactly the same as 2004 [Fannie Mae]](http://www.fanniemae.com/media/berson/weekly/index.jhtml;jsessionid=KPJ4BQEYIRRT5J2FQSISFGQ?p=Media&s=Economics,+Housing+%26+Mortgage+Market+Analysis&t=Berson’s+Weekly+Commentary) he reviews the Fed’s Flow of Funds statistics for 2005 and he found the following:

_[Warning: Berson’s link lasts one week. For an acrhive of stories including this one go here.](http://www.fanniemae.com/media/berson/weekly/archive/index.jhtml;jsessionid=GQATCTK1I5SX1J2FQSHSFGI?p=Media)_

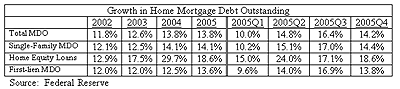

* US households borrowed using home mortgages at the same growth rate in 2005 as they did at 2004.

* Pace of increase slowed in 4th quarter of 2005.

* Growth rate was 14.2% annual, the 4th consecutive year of double-digit growth.

* Home equity grew 15.9% in 2005 and was at highest rate since 1979.

* Debt to value decline slightly from prior year but higher than 10 years ago.

_What’s expected for 2006?_

* Lower home price appreciation and a lower volume of home sales and refi’s is expected to lower rate of MDO growth.

* Fannie Mae expects a surge in home equity lending.

In other words, property owners are expected to continue to borrow against their properties in significant numbers this year. This makes the direction of mortgage rates a significant barometer for national economic health. Fannie Mae is (obviously) pro-lending, so I would think that lending will (and has) dropped significantly, reflective of the lower number of sales and less attractive refi terms.

Its not clear to me how mortgage origination can sustain nearly double digit growth in 2006. Its not logical, unless mortgage rates fall, which is hard to imagine with the Fed projected to raise short term rates 1-2 more times.

Its unlikely to expect long terms rates to fall in the immediate future, so the best-case scenario for the housing market is to hope for Goldilocks [Not too hot, Not too cold [Matrix]](http://matrix.millersamuelv2.wpenginepowered.com/?p=481) and have rates remain where they are.

[Fed Chairman Bernanke was quoted today as saying [CNN]](http://money.cnn.com/2006/03/20/news/economy/bernanke.reut/?cnn=yes) essentially that the economy remains strong, despite what is happening to housing which probably means the Fed will continue with belt-tightening 1-2 more times. I think low bond yields (low mortgage rates) are more about our balance of trade with China than anything.>…long-term rates could suggest the level of short-term rates consistent with holding the economy at full employment had declined, perhaps reflecting a lasting drag on the economy from high energy costs, slower growth in house prices and the possibility consumers will begin to save more.

_But he also noted long-term rates were low around the globe and said “an explanation less centered on the United States might be required.” One other factor that Bernanke raised, but downplayed, was that large official holdings of U.S. Treasury debt accumulated by countries intervening in currency markets was doing much to push U.S. long-term rates down._