Not a month goes by that Larry doesn’t say housing is getting better and that mortgage problems are temporary.

>Lawrence Yun, NAR chief economist, expected the sluggish performance. “As noted last month, temporary mortgage problems were peaking back in August when many of the sales closed in October were being negotiated. We continue to see the biggest impact in high-cost markets that rely on jumbo loans,” he said. “Mortgage availability has improved as evidenced by much lower mortgage interest rates and a sharp jump in FHA endorsements for home purchases.

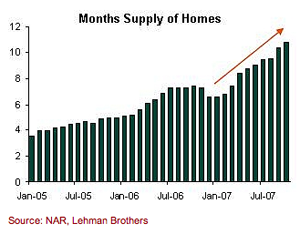

I was wondering what mortgage data Larry is referring to? I don’t believe its part of his research but is a primary basis of rationalization for glowing market conditions, despite the fact that inventory tracked by NAR is at its highest level since 1985 and has continued to rise despite temporary mortgage problems.

Here’s what I said about Mr. Yun’s choice of the word “temporary” last month. Hmmm… perhaps this should be a monthly ritual until he stops using the word. Even then, we can’t be assured it will be temporary.

I yearn for the day when NAR finds that perfect moment and decides to inform the public and the consumer what is happening in the housing market, rather than assume we are illiterate. I know many, many brokerage firms and agents that agree with this. PR driven quotes like this don’t move markets so what is there to be afraid of?

UPDATE: Here’s a related article referencing some of my feelings about this topic in a Business week piece: Northeast Home Prices Remain Strong: Unlike the rest of the U.S., the region has seen price increases for the past six months. But a bad bonus season could change that

7 Comments

Comments are closed.

Bravo Jonathan , you were right once again.

By the way , dod you know taht your opinions are quite popular on west coast as well?

way to go Jonathan! NAR, between Lereah & Yun, has lost ALL credibility and its pretty clear that no media outlet or even blog considers anything they say anymore.

They are nothing more than cheerleaders for a volume based commissioned industry. Its a shame they do not learn from their lessons.

If blogging is web 2.0, the NAR is web -3.0. Let them continue to move backwards!

Propaganda has not been helpful and if anything it has proven to be dangerous I concur they should stop and for lack of a better word they should try transparency.

Noah and Robert are right on. For many, NAR data and information has become like a story in a supermarket tabloid.

One would think that the thousands of NAR members would be embarrassed and speak up against this propaganda being released on their behalf.

However, I am convinced that they do not object because the real estate market (like the stock market) is largely fueled by the prevailing level of market sentiment even if it’s being touted from a less than credible source. In essence, they know how powerful & necessary it is and nothing less than favorable market sentiment from any source or means is acceptable. And just how to play it in an up, down or flat market. They also know that in a down market, true transparency is the poison pill.

Naturally, as more independent analysts and transparent data providers like Jonathan emerge, the NAR and it’s members will be become even more marginalized in the market reporting and forecasting arena. And in the end that will be a good thing and the consumer and those of us who need reliable data will benefit most.

Well done Jonathan!

Could we expect Manhattan prices to follow the rest of the cities in USA? What do you think is more probable? Home prices going down by 20% or just 10% (nominal, say next 5 years).

My take is that there’s no way Manhattan can sustain prices and will have to give up credit bubble gains. Look at the counties around it, they are Alt-A and subprime land. But, never underestimate BB and Mishkin when it comes to printing paper! That’s the wild card for me. How much are they willing to print in order to artificially keep prices at current levels?

Agreed & thanks for the article. NAR is already on the path to becoming forgotten.

[…] as head of a group of people that earn their salaries on transaction commissions.” And Jonathan Miller at Matrix, “Not a month goes by that Larry doesn’t say housing is getting better and that […]