It depends on who you listen to…

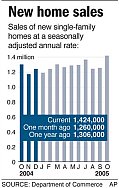

Today the US government reported [a record number of new-home sales [MarketWatch]](http://www.marketwatch.com/news/story.asp?guid=%7B4EC23421%2D171A%2D40BF%2DB72F%2D9CFFCEBF35D3%7D&siteid=mktw) which seemingly contradicted [yesterday’s release of existing home sales [WSJ]](http://online.wsj.com/article/SB113318905850108049.html?mod=djemTAR) by NAR.

This has brought further debate to the housing market interpretation. The media seems to be betting on [a burst of the bubble [MarketWatch]](http://www.marketwatch.com/news/story.asp?g=37D276C5905045B9B001A0BF686A184C&siteid=mktw&dist=nbk) while the NAR seems confident in a soft landing next year.

The MarketWatch article suggests three paths are possible:

1. “any further acceleration in housing could fuel a spurt in consumer spending, but at the risk of forcing the Federal Reserve to continue raising interest rates beyond what’s now expected.”

2. “a collapse in housing, if it were to happen, could slow job growth, shatter consumer confidence and lead to a significant retrenching in their spending.”

3. “a gradual decline in housing would likely keep the U.S. economy growing at a slower but healthier pace, allowing the Fed to conclude its rate hikes. Most economists expect this third option to come to pass.”

“Being the first to call the end of the housing boom has become a favorite parlor game for economy watchers. As evidence, they’ve gleefully pointed to the reduction in mortgage applications, to an increase in unsold homes on the market, to a slowing in home price appreciation and to a drop in home-builders’ confidence.”

This is interesting because the existing home report and the new-home report are based on [a different data set and mean very different things in a changing market [Matrix].](http://matrix.millersamuelv2.wpenginepowered.com/?p=195)

Existing home sales lag the market by 30 to 60 days or more because they reflect closed sales. New home sale stats are based on contracts.

So if there is a change in the market, new home sales would be considered the leading indicator. However, its reliability should be tempered by the fact that new home sales represent about 10% of existing home sales.

In other economic stats released today:

At the same time, [consumer confidence spiked [Forbes.com]](http://www.forbes.com/business/manufacturing/feeds/ap/2005/11/29/ap2359063.html) reversing a 2-month slide.

[US Factory orders rose 3.4% and durable goods orders posted strong gains as well. [ABCNews]](http://abcnews.go.com/Business/wireStory?id=1356003)