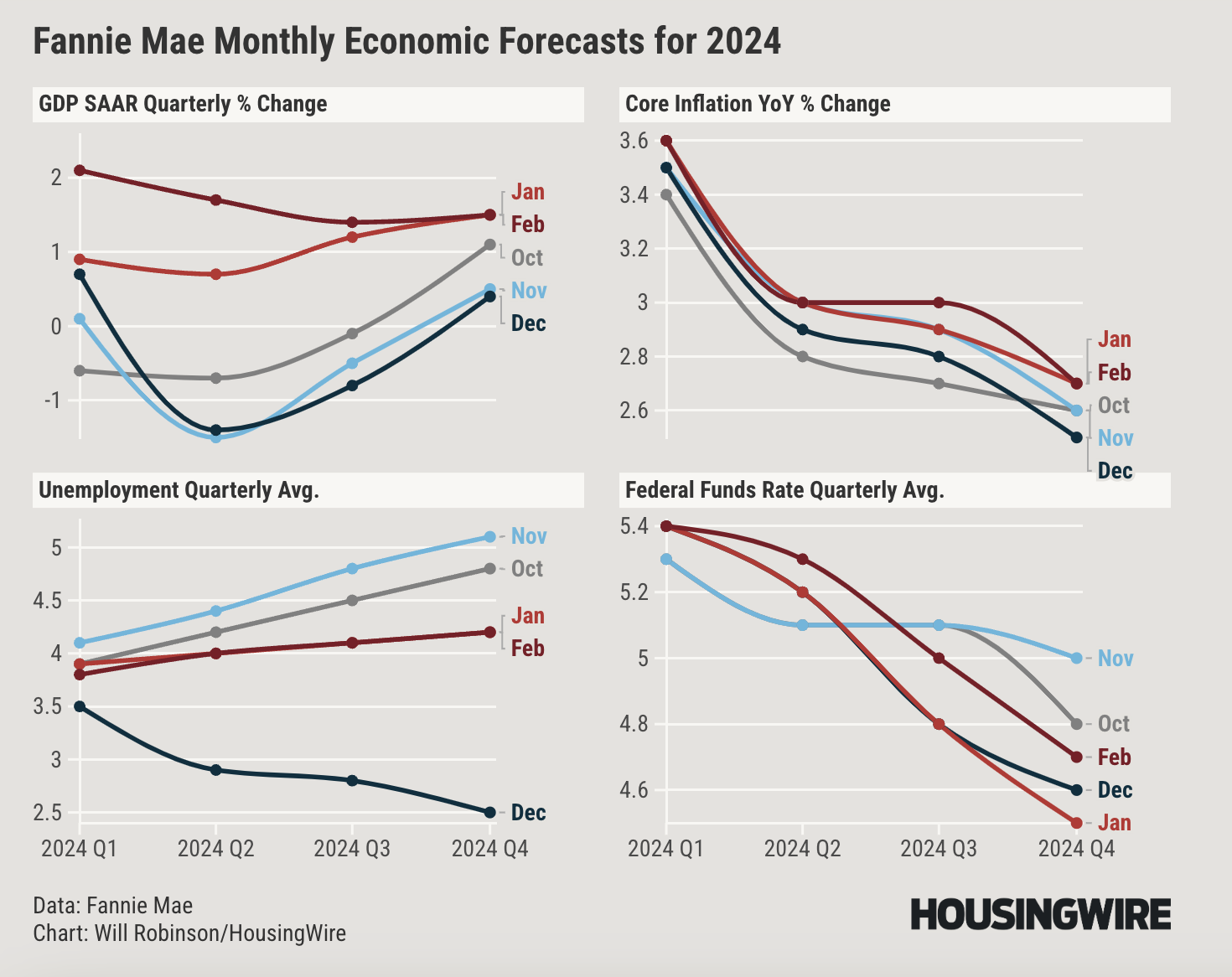

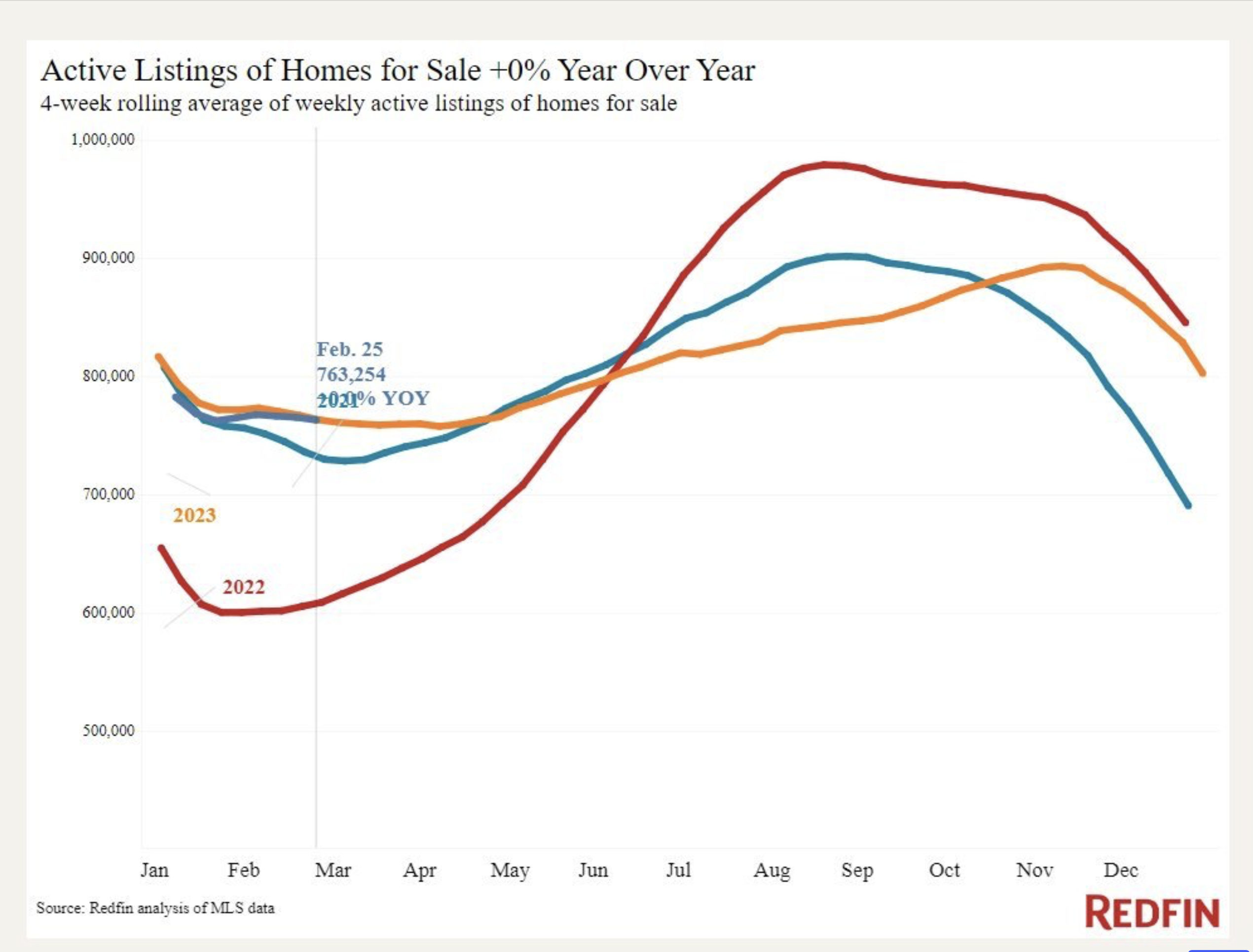

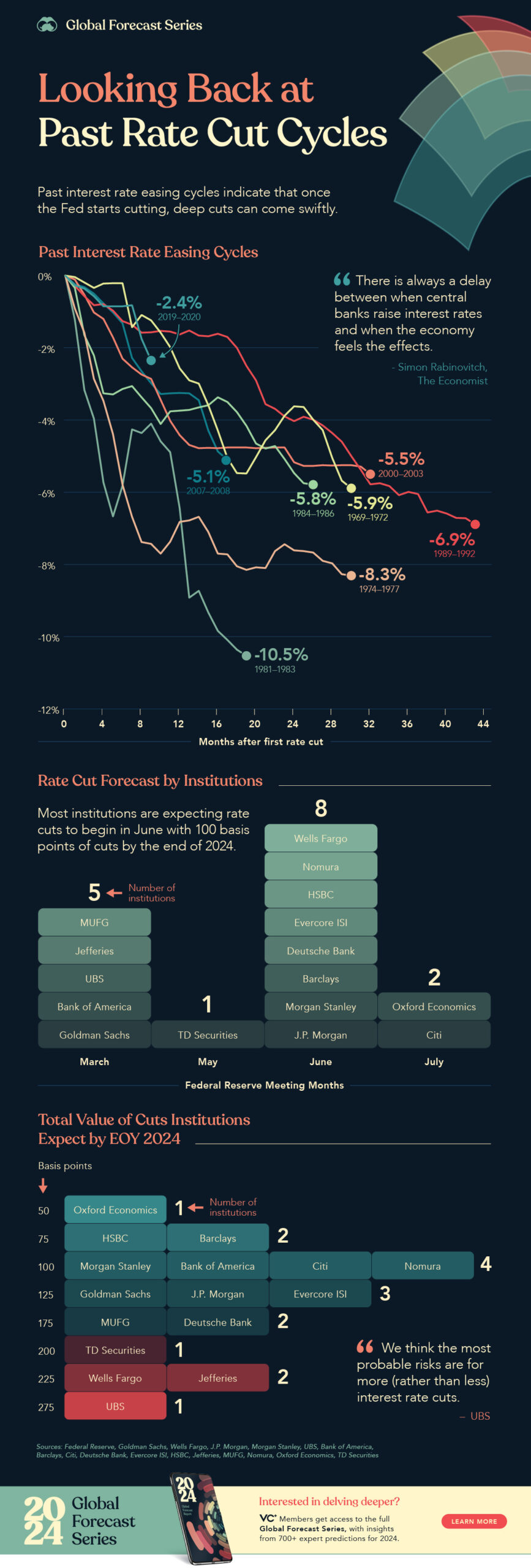

Since we are in the middle of a date palindrome this month, I thought it would be helpful to compare this phenomenon against the backdrop of the housing market. Mortgage rates have remained elevated in the New Year and are expected to remain similar over the next several months despite the Fed pivot last December. With rate cut expectations being pushed out to the end of 2024, if not 2025, the...

![San Diego County Average v. Median Sales Price [Single Family, Condo]](https://millersamuel.com/files/2024/01/1Q24SD-avgMED-1200x794.jpg)

![[27 Speaks Podcast] Jonathan Miller Provides A 2024 Hamptons Outlook](https://millersamuel.com/files/2024/02/27eastlogo-600x314.jpg)