When I was a teenager growing up in the DMV – before I had a driver’s license – my mom took me to the mall to buy my first new record album. It was my birthday and I wanted Led Zeppelin’s double album Physical Graffiti. Half the reason I wanted the 6th Zeppelin album was for the cover art. A decade letter when I found my way to Manhattan, little did I know that the cover photo was of 96 – 98 St. Mark’s Place in Manhattan’s East Village neighborhood and was the reason the album release was delayed.

But I digress…

Just When I Thought We Were At ‘Peak Uncertainty’ There’s A Virus To Worry About

Recently I dubbed 2020 as ‘Peak Uncertainty’ – a state of mind where the entire world around us seems to be imploding and each issue sticks out like a sore thumb. The combination of all concerns creates anxiety:

– Falling mortgage rates despite a booming economy

– A trade war without logic that costs U.S. consumers (forcing rates to fall)

– An unusually polarized electorate

– Federal SALT tax fall out in high cost, high taxed housing markets

– Anti-real estate/landlord/development political zeitgeist in New York State

– Housing price trends outpacing wage growth, reducing affordability

– Odds of a recession in 2020 hovering between 25% and 60% depending on the source.

Despite that, I have been seeing a slight (anecdotal) uptick in activity in NYC metro since the New Year – more offers being made. Why? Perhaps because enough time has passed for consumers to acclimate to all the challenges of the past two years.

but now…

– a 42-day old global virus outbreak…

I’ve got a few dashboards on the Coronavirus later on in these Housing Notes, but the question remains. What will be the impact to the U.S. housing market?

ONE An extreme scenario, suitable for TV except that its real-life:

– The shut down of the Chinese economy triggers a global recession

– Central bank rates across the globe fall back to zero or go negative

– After many initial errors by the resource-gutted CDC and the feds, there is a domestic expansion of the virus

– U.S. mortgage rates fall even further driving up more refinance activity

– A realization that common surgical masks are useless against the virus and only incite panic

– Negative mortgage rates begin to appear

– A U.S. recession begins as international exports and domestic consumption falls sharply

– Low mortgage rates trigger some uptick in sales but the uncertainty of a recession restrains much of the uptick in demand.

– The Walking Dead TV series gets picked up with a three-season deal

TWO Another extreme scenario might be that none of the above happens anywhere close to the degree that prognosticators suggest.

The thing is, consumers will likely tend to pause until they have wrapped their minds around the chaos they are reading about. And that’s why we are further entrenched in “Peak Uncertainty” with the virus addition to the list.

Time has to pass before normalization occurs. And no I don’t watch The Walking Dead.

In This Market Correction, Who Do You Call First?

CNBC’s long time stalwart of financial news asks this question:

I can’t decide who to call first — my stock broker or my mortgage broker.

— Bill Griffeth (@BillGriffeth) February 27, 2020

Well, who do you call? Pick one.

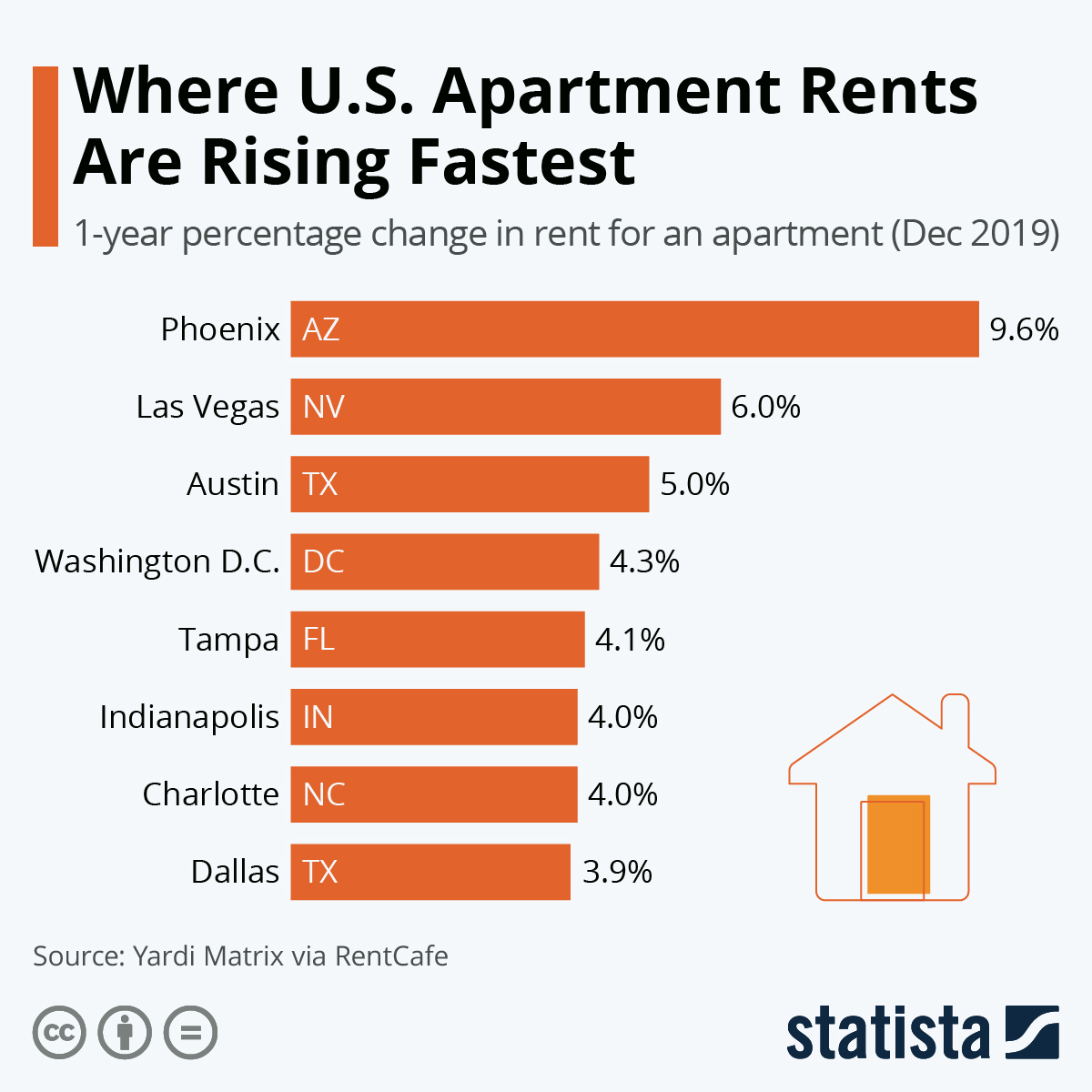

The Fast Growing Rents Are NOT in New York or San Francisco

You will find more infographics at Statista

You will find more infographics at Statista

The New York Investment Sales Market Keeps Falling, But Optimism Growing As Sellers Get Real

Bob Knakal of JLL lays it out clearly. Click “Watch on Vimeo” when you see the prompt.

KNN 155: 2019 Year-End New York City Investment Sales Market from Bob Knakal on Vimeo.

Getting Graphic

Our favorite charts of the week of our own making

Upcoming Speaking Events

May 1, 2020 Stony Brook, NY – John Kominicki Symposium 2020 More info coming!

May 14, 2020 Teaneck, NJ – Spring Conference for The Northeast NJ Chapter of the Appraisal Institute More info coming!

Appraiserville

(For earlier appraisal industry commentary, visit my old clunky REIC site.)

We’re helping my son and his wife move into his first home today and over the weekend so I’m not going to get into appraisal issues this week (their appraisal came into value, lol). The mortgage rate drop has made homeowners of my three oldest sons in the past 18 months!

OFT (One Final Thought)

Because we never seem to have enough data to overwhelm us, here is a dashboard by Andrzej Leszkiewicz on the Coronavirus COVID-19 (click image to open):

Here’s another great dashboard of the Coronavirus COVID-19 by Johns Hopkins CSSE (click image to open):

h/t @ritholtz

Brilliant Idea #1

If you need something rock solid in your life (particularly on Friday afternoons) and someone forwarded this to you, or you think you already subscribed, sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll be more contagious;

– You’ll call your bartender;

– And I’ll play ‘Custard Pie.’

Brilliant Idea #2

You’re obviously full of insights and ideas as a reader of Housing Notes. I appreciate every email I receive and it helps me craft the next week’s Housing Note.

See you next week.

Jonathan J. Miller, CRP, CRE, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog

@jonathanmiller

Reads, Listens and Visuals I Enjoyed

- New York State’s Pro-Tenant Law Snarls Hamptons Mansion Rentals [Bloomberg]

- New York City's Changing Real Estate Landscape: Why Co-ops Have To Adapt [Forbes]

- Ilan Bracha Sells Keller Williams NYC [The Real Deal]

- Eli Broad’s Richard Meier-Designed Home on Malibu’s Carbon Beach Lists for $75 Million [Wall Street Journal]

- This Home Design Company Is on A Mission to Change The Way Homes Are Built [Inc.com]

- A Baltimore County cul-de-sac is no more after flood-weary residents made a decision many communities face [Baltimore Sun]

- Surviving hurricanes, sea rise in Keys may mean $3 billion in home buyouts, elevations [Miami Herald]

- Coronavirus Update: Spread Outside China Is Raising Risks [Northern Trust]

- Losing Residents but Still Growing: How Migration and Population Change Affect Cities – Blog [Joint Center for Housing Studies of Harvard University]

- Localize City Analysis Shows Rent Increases During Broker Fee Ban [The Real Deal]

- New York Eyes Luxury Buildings in Search for Homeless Fix [Bloomberg]

- Amazon Mulls Purchase of WeWork’s Lord & Taylor Building [The Real Deal]

- You can ‘buy’ this guy’s NYC luxe life for $11,000 [NY Post]

- Our Sluggish Luxury Market Still Beats NYC’s “Bloodbath” [Chicago Mag]

My New Content, Research and Mentions

- Hamptons rentals market heating up for summer [Newsday]

- Hedge Fund Billionaire Buys Priciest House in Palm Beach History for $111 Million [Mansion Global]

- Good Cause Eviction Might Not Exempt Condos and Co-ops [The Real Deal]

- Fawaz Alhokair Bought Bel Air’s $94 Million Billionaire Estate [Variety]

- More Info Equals Less Risk: Why Transparent Housing Markets Are Better Bets [Mansion Global]

Recently Published Elliman Market Reports

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 1-2020 [Miller Samuel]

- Elliman Report: Manhattan Decade 2010-2019 [Miller Samuel]

- Elliman Report: Manhattan Townhouse 2010-2019 [Miller Samuel]

- Elliman Report: Venice + Mar Vista Sales 4Q 2019 [Miller Samuel]

- Elliman Report: Malibu + Malibu Beach Sales 4Q 2019 [Miller Samuel]

- Elliman Report: Los Angeles Sales 4Q 2019 [Miller Samuel]

- Elliman Report: Aspen + Snowmass Village Sales 4Q 2019 [Miller Samuel]

- Elliman Report: North Fork Sales 4Q 2019 [Miller Samuel]

- Elliman Report: Hamptons Sales 4Q 2019 [Miller Samuel]

- Elliman Report: Long Island Sales 4Q 2019 [Miller Samuel]

Appraisal Related Reads

- Moving money, duplexes, & unicorns. [Sacramento Appraisal Blog]

- Joe Biden wants tougher standards for real-estate appraisers to help black and Latinx homeowners [Market Watch]

- Does a Bedroom Need a Window To Be Legal? [Birmingham Appraisal Blog]

- Appraisers CASH the Darn Check! [Dave Towne/Appraisers Blogs]

- Borrower Class Action Against LandSafe Appraisal Settled for $250 Million [Peter Christensen/Appraisers Blogs]

- Billionaire buyers strengthen hold on Aspen real estate [Aspen Daily News]

Extra Curricular Reads

- U.S. health officials say Americans shouldn’t wear face masks to prevent coronavirus — here are 3 other reasons not to wear them [Market Watch]

- A Corridor Runs Through It [The Bitter Southerner]

- The siren song of Starbucks [Vox]

- Podcast: Guy Kawasaki Discusses Remarkable People – Steve Wozniak: Pirate, Co-founder of Apple, and Hardware Wizard [Remarkable People]

- Read Warren Buffett's annual letter to Berkshire Hathaway shareholders [CNBC]

- Cold Words for Cold Times : Croodle [Merriam Webster]

![San Diego County Average v. Median Sales Price [Single Family, Condo]](https://millersamuel.com/files/2024/01/1Q24SD-avgMED-1200x794.jpg)

![[27 Speaks Podcast] Jonathan Miller Provides A 2024 Hamptons Outlook](https://millersamuel.com/files/2024/02/27eastlogo-600x314.jpg)