It seems a bit early to start reflecting on the lessons learned from the housing/mortgage problems we face, since, well, we still face them.

Don’t get me wrong.

It is always good to look back over your efforts and evaluate whether anything different could have been done to yield a different result. It is just that this infers closure and it is too early to summarize.

OFHEO – James Lockhart, the director spoke last week at the 44th Annual Conference on Bank Structure and Competition in Chicago (think Auto show, only less metallic paint) on the “Lessons Learned from the Mortgage Market Turmoil.”

He arrived on the scene after the party already begun and despite the criticisms levied towards both him and his agency, I actually think he did well with what powers he has to employ.

Plus, he likes charts “To set my remarks in context, I often like to start with a chart that gives some perspective…” Start with a chart and I am on your side.

Key lessons learned

* what goes up too far goes down too far. In other words, bubbles burst.

* mortgage securities are risky and that there is a long list of financial firms that have had

problems with those securities, including problems related to model, market, credit, and

operational risks. A key lesson from the savings and loan crisis that was ignored was not

to lend long and borrow short, as structured investment vehicles (SIVs) did.

* Another lesson ignored is that in bull markets investors and financial institutions tend to misprice risk, which can result in inadequate capital when markets turn.

* A new lesson that should be learned is that

putting subprime mortgages, which almost by definition need to be worked, into a “brain

dead” trust makes no sense.

* Another lesson is that overreliance on sophisticated, quantitative models promotes a

hubris that has frequently caused serious problems at many financial institutions

Lessons learned specific to the GSEs

* The first is about pro-cyclical behavior during the credit cycle. An important issue for supervisory agencies is how to create incentives for institutions to

behave in a less pro-cyclical manner without interfering with their ability to earn

reasonable returns on capital.

* A second lesson from recent experience is the importance of capital. Capital at

individual institutions not only reduces their risk of experiencing solvency and funding

problems and of contributing to financial market illiquidity, but also helps them avoid the

need to retrench in bad times and miss what may be very attractive opportunities in weak

markets.

* Those two lessons provide compelling arguments for a third: legislation needs to be

enacted soon that would reform supervision of Fannie Mae and Freddie Mac and,

specifically, give a new agency authority to set capital requirements comparable to the

authority the bank regulatory agencies possess.

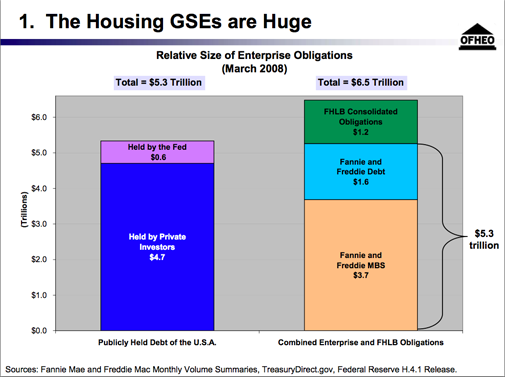

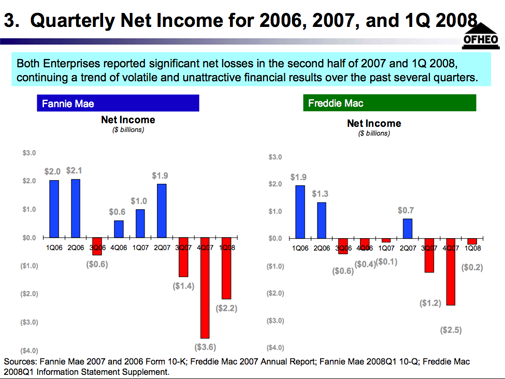

These are important points because the GSEs dwarf other debt and the GSEs have been losing money as of late. Here’s a few charts that may be of interest from his speech:

FDIC – Sheila Bair, FDIC CHairman was speaking in Washington, DC at the Brookings Institution Forum, The Great Credit Squeeze: How it Happened, How to Prevent Another http://www.fdic.gov/news/news/speeches/chairman/spmay1608.html on the same day Lockhart was speaking in Chicago. A full court press of self-reflection. Like Lockhart, Bair has been very outspoken and I believe lucid in her depiction of the problems at hand. To her credit, she has clearly articulated the problem with the mortgage system.

Her salient points are:

* …things may get worse before they get better. As regulators, we continue to see a lot of distress out there.

* Data show there could be a second wave of the more traditional credit stress you see in an economic slowdown.

* Delinquencies are rising for other types of credit, most notably for construction and development lending, but also for commercial loans and consumer debt.

* The slowdown we’ve seen in the U.S. economy since late last year appears to be directly linked to the housing crisis and the self-reinforcing cycle of defaults and foreclosures, putting more downward pressure on the housing market and leading to yet more defaults and foreclosures.

* Reform is not happening fast enough

* She explains HOP loans are NOT a bailout

* The housing crisis is now a national problem that requires a national solution. It’s no longer confined to states that once had go-go real estate markets.

* The FDIC has dealt with this kind of crisis before.

Take away

>Both OFHEO and FDIC seem to be saying we need to take action now and they were powerless to do anything before this situation evolved into its current form?

It makes me wonder whether any regulatory proposals will do much good. Regulators did not take action or propose safeguards while the problem was building. How can they suddenly have wisdom now? While these recommendations and insight seem prudent but isn’t it kind of late for that?

Speaking of monoliths, here’s Steve Ballmer getting egged in Hungary.