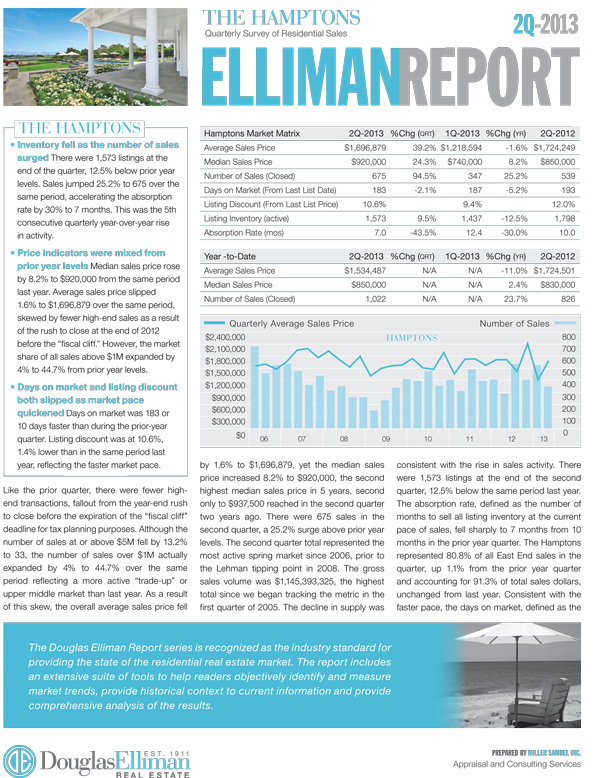

…Like the prior quarter, there were fewer highend

transactions, fallout from the year-end rush

to close before the expiration of the “fiscal cliff”

deadline for tax planning purposes. Although the

number of sales at or above $5M fell by 13.2%

to 33, the number of sales over $1M actually

expanded by 4% to 44.7% over the same

period reflecting a more active “trade-up” or

upper middle market than last year. As a result

of this skew, the overall average sales price fell

by 1.6% to $1,696,879, yet the median sales

price increased 8.2% to $920,000, the second

highest median sales price in 5 years, second

only to $937,500 reached in the second quarter

two years ago…