[source]

[source]

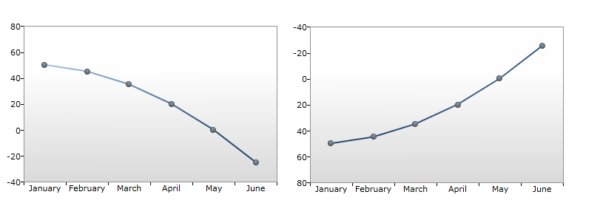

When we look at forecasting, planning, trending or anything that includes a look out over the future, I find the real estate industry (i.e. appraisers, real estate agents & brokers) generally thinks along linear lines.

For example:

– When housing prices rise…they will rise forever.

– When housing prices fall…they will fall forever.

– When sales activity rises…they will rise for ever.

– When inventory falls…it will fall forever.

– When rental prices rise…they will rise forever.

…and so on.

Where does this status quo bias come from?

I don’t think this bias only specific to the real estate industry – but I describe it through the industry only because it simply happens to be my area of focus. I do find that real estate professionals can be quite disconnected from the mindset of their clients when the market is at extreme points in the trend i.e. peak and trough.

For example, in the dark days following the Lehman Brothers bankruptcy, I was giving a speech to a large group of New York real estate agents in October of 2008. Roughly a dozen agents approached me before and after my presentation saying they were getting offers on their listings at roughly 30% below ask, characterizing the offers as “lowball.” It was quite amazing to hear all the agents use a similar characterization of the post-Lehman market. Of course when nearly all buyers are behaving in the same manner, that becomes the new market condition.

Towards the end of 2008, I found that New York real estate agents rapidly changed their view on the market as sales contract activity fell by 75% YoY. The real estate agent disconnect with the consumer was evident by the early spring of 2009 when it was apparent that buyers were not as negative in their outlook of the coming real estate year as the typical agent was. Needless to say that the market did see a significant rebound over the following year and the consumers were ultimately right.

My takeaway from all of this is never to get too comfortable with a trend. Although we like to say “the trend is your friend,” it is only your friend “until it ends.”

I would think this “status quo bias” behavior manifests itself more strongly in professions that are sales commission heavy, i.e. where commission incentives and generally over-the-top positive thinking are the norm and the agent tries to feel like they have some control over the impact of the market on their livelihood.

Of course the real estate market could care less what anyone thinks.

______________________________________

I was away last week, invited by the US Army to participate in a seminar at the US Army War College in Carlisle Pennsylvania after they heard me give a speech about the evolution of our company. Last week was a complete strategic immersion at the college and frankly I didn’t think a whole lot about the housing market or social media. I met an impressive group of accomplished military veterans who are furthering their careers. I also got to meet civilians like me from around the country that were also invited to participate. I gained invaluable strategic insights and friendships from this event that have made a real impact on me and how I interpret information that is presented to me.

2 Comments

Comments are closed.

[…] question. When a long term trend seemingly changes direction, it is reasonable to point it out. As I opined previously, the housing industry often defaults to linear thinking. It’s not enough to point out a […]

Interesting article. I wonder if there’s a deep-seated psychological reaction to change at play here too. For example, most of us don’t like a lot of change especially when we’re comfortable, so when markets do shift up and down, my sense is that getting the people who work in that business to shift their approach in lock-step to the environmental changes is a real challenge. There will be early changers, then the vast majority who grudgingly go along after fighting or ignoring the change, and finally the straggler who can’t change.