_[Sorry for the late posts today, a bit under the weather -ed]_

There has been a lot of discussion about retirement and housing late – here are two studies that discuss the trends. The fist is a report by FDIC that discusses baby-boomers and immigrants with housing demand. The second study, which is not available yet, was done by the Federal Reserve discusses the the impact of the growing baby-boom retirement population and its impact on the economy.

[Banking on the Baby Boomers: How Demographic Trends Are Reshaping the Financial Landscape [FDIC (pdf)]](http://www.fdic.gov/bank/analytical/regional/ro20061q/na/t1q2006.pdf)>A snapshot of U.S. population growth during the past 20 years shows significant increases in the numbers of aging baby boomers and foreign-born individuals. Although these groups differ in age, income, education level, and household size, both are expected to significantly affect the demand for owner-occupied housing.

The housing discussion begins on page 17.

* Baby boomers are living longer, are wealthier and more active than prior generations

* Current research finds that they don’t exclusively favor the sun belt states anymore

* They are downsizing but want homes with more amenities.

* They prefer 1-family, 1-story homes with hgiher ceilings and larger garages

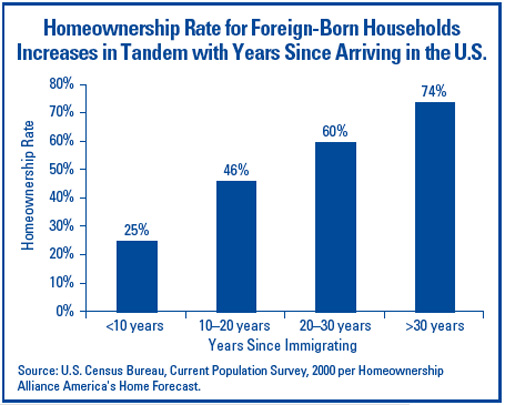

* Imigrants are a large group with considerable potential for growth

_also_

_A new Federal Reserve study has shaken economists’ forecasts by suggesting the U.S. economy will have to decelerate much more over the next decade than most now expect._

[Revolutionary Fed Study Has Economists Rethinking Forecasts [Bloomberg]](http://www.bloomberg.com/apps/news?pid=10000103&sid=acqbH7wK9LK8&)>The study, to be published in July, finds that the retirement of the Baby Boom generation will force far-reaching adjustments in the way the economy works. Forecasts for everything from growth and employment to corporate profits and interest rates will have to be recast.

The problem will be that the retirement of baby boomers will weaken the labor force over the next 10 years. With a smaller work force to sustain the economy, there is more inflationary pressures and wage pressures ahead. This could complicate the Fed’s task of keeping inflation reigned in by keeping moortgage rates at a higher level.

2 Comments

Comments are closed.

BusinessWeek Online has a good discussion of this study, with the conclusion being that “demography is not destiny.” Many of these Boomers supposedly leaving the workforce, causing wage inflation, etc., have too little retirement savings to retire.

http://www.businessweek.com/the_thread/economicsunbound/archives/2006/04/demographics_is.html?campaign_id=rss_blog_economicsunbound

The impact of retiring baby boomers on the labor force has been kicked around for a while now. It will have an affect on the country’s economy/growth but not neccesarily the devasting impact that’s been prognosticated for the following reasons:

1) We don’t have the “wealth” everyone thinks we have to retire full time.

2) Baby boomers are not the type to sit around in the rocking chair or aimlessly travel/play golf ect their remaining lives away. We were once a very involved, motivated, activist group of people who believed we could ” change the world” and for a while we did and left a legacy which was not all that bad.

4) It is not in our best interest to let things go downhill.

3) We know that work, involvement with people, especially young people, learning new things, using one’s mind, feeling valued and lots of laughter are some of the most effective ways of staying young mentally and phisically. And Baby Boomers will not grow old if they can help it.

So don’t be afraid – we won’t let the country down – remember our parents were the “Greatest Generation” and they taught us well.