Ok, I am on an appraisal-related commentary binge lately. But thats to be expected when the lending system is in upheaval and the appraisal industry was the enabler of the misguided/unethical application of risk. Some of it was the appraisal industry’s fault for capitulating to pressure, while an equally large portion of blame goes to lenders who applied the pressure.

There has been a shift in the deal dynamic as evidenced in this recent article: Suddenly, Stricter Appraisals by Lisa Prevost in the New York Times.

>”A house is only worth what the bank says,” said Terry Hastings, a partner at Hamilton Mortgage, in Ridgefield. “It’s not worth what the buyer says anymore.”

Spoken like a mortgage broker. One of the reason so many mortgage brokers have gone under in the past year has been their inability to find “good appraisers.” I continue to be amazed that most people think banks call their appraisers in and tell them to be “more conservative.”

It’s all about underwriting these days. Banks are actually reading reports now (I kid you not).

>Mortgage lenders determined to stave off additional losses are demanding more thorough home appraisals and carefully reviewing valuation figures. If an appraisal is deemed too thin on supporting data, lenders may reduce the loan amount for the property, or not make the loan at all.

If lenders aren’t comfortable with the appraisal or the data is too thin, the underwriter simply raises the LTV.

>Lower-than-expected bank appraisals are indeed sending some buyers and sellers back to the bargaining table for another go-round, said Rosamond A. Koether, a lawyer with Cohen & Wolf, in Westport. But in her experience, the tougher appraisal standards are more often an obstacle for homeowners hoping to restructure debt by refinancing.

If buyers and sellers willing re-negotiate the deal because of a low appraisal. Guess what? That’s market value.

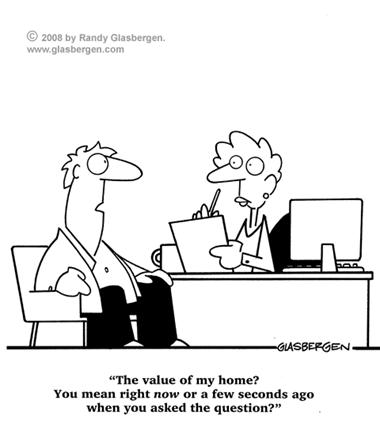

What’s interesting about the article, is the mention of the greater difficulty in refinancing and the appraisal. That’s because of two reasons. First, there is not a flesh out transaction to observe between a buyer and seller to create value credibility. Secondly, the property owner is more likely to estimate their property value based on what they need, rather than what it is worth. The orientation is skewed after years of simply asking what they needed and getting it (or more).

>Many lenders are requiring “comps” sales of comparable properties used to help determine a home’s value no more than 60 to 90 days old, and within a mile of the property being appraised.

While that’s a reasonable and fair request in a changing market, there are fewer sales in many housing markets today and meeting these suddenly stricter expectations is not possible, which essentially leads to a deal being killed.

One of the items that was not mentioned in the article is the blame the appraiser gets for a deal falling through. Often times, a bank or mortgage broker will tell the borrower that the appraiser “killed” the deal or presented something that prevented the deal from happening. A very sleazy practice to say the least.

The biggest problem in lending today is the fact that while they are more strict with underwriting, they haven’t done a thing to improve the quality of the appraisers they hire. They are still focused on low cost appraisals, bang ’em out. Given the mortgage market upheaval…it’s amazing.

>”It used to be banks would call and the first question they would ask was, ‘How familiar are you with a particular area?'” he said. “Now, that conversation starts with, ‘What’s the lowest fee you can offer and what’s your fastest turnaround time?'”

In the state of this housing market, the word “strict” needs to be appraised for it’s relativity.

Aside: This stuff is all very interesting, but how does this trade group track this specific data? Enquiring minds want to know.

5 Comments

Comments are closed.

This has nothing to do with this post but I need input. Four of us are going to Radio City for a show at 10:00 am on Black Friday and my girlfriend thinks we should drive (from Stamford, CT). I think we should take the train. Please weigh in with your advice and counsel.

Appraisal Management Companies should manage appraisal requests as a second party to a sale or refinance transaction from a mortgage lender/broker and NOT for making a profit from their wholly/partially owned parent company. Appraisalport charges a $7.00 fee for their appraisal transactions. They send appraisal requests via e-mail to an approved appraiser list that is computerized and staggered. I know there are new issues with Appraisalport and their new contract. This will need further consideration once it comes out in December. AMC’s that maintain staff appraisers is a direct conflict of interest. Fee’s are pre-set by the AMC’s based upon value. USPAP violation? Staff appraisers are maintained for ONE reason only. PRODUCTION and PROFIT for their parent company. Produce or be fired in this down market. Staff appraisers must maintain a certain output of appraisals per month. As a past staff appraiser, the reviewers and underwriters gave us more a benefit in values than the outside independent appraisers values. Bottom line, who reviews the staff appraisal work? The review work of AMC’s staff appraisers is handled internally. If an appraiser gets a poor review on an appraisal, it is dealt with internally and swept under the carpet because he/she does a productive 40 appraisals a month. Produce 40 “C” type of appraisals for profit rather than 20 requests at a “A-B” level appraisals for quality affairs.

This profession is going the wrong way. The independent appraiser profession is being squeezed out for the staff position and potential profit position. Take a look, with the new requirements, there is no way for a rookie appraiser to get into the field based upon requirements at the State level. Leaving these type of decisions and control to larger mortgage companies and their lobbyist groups is exactly what is happening. Too big to fail, if so, go and seek to be bailed out by the Fed’s due to un regulation of this profession. Under the new regime, lets get the Federal government and outside independent professions involved, rather than leave this un regulated to larger mortgage players to regulate themselves. It appears it didn’t work in the past. Let’s get back to 20% down and 80% loan. It worked in the past. Limit subprime loans. Do away with mortgage brokers that deceive their clients and sell their loans to the larger mortgage only to fail.

Just a thought.

“the appraisal industry was the enabler of the misguided/unethical application of risk. Some of it was the appraisal industry’s fault for capitulating to pressure”

Well no excuse for those who tell ’em whjat they want to hear, but I think the appraisal industry has done a lot more to enable chaos than just caving into pressure.

a. Education it seems is mostly an inconvenience where appraisers are alerted to listen carefull to what will be on the test.

b.There is no agreement among the various factions as to what an appraisers really needs to do.

c. There is no degree or regimine of higher education for the “profession.”

d. There is no organization that acts as a voice for appraisers. Instead there are several fraternities babeling about the merits of their own designations.

e. Fannie Mae has more influence over how appraisals should be written than the industry is.

f. With the euphamistic statement that appraisers should be independently free to run their own businesses bt what little leadership there is, appraisers have persistently lowered their fees and sped up “turn times” to meet demand at the expense of quality.

f. The ASB stood up to “comp checks”, but you can attend any USPAP class and learn ways around the official sanctions.

All that remains to be proud of are the standards we insist on as indivduals. There is currently nothing more.

The enabling no doubt was augmented by individuals, but the profession has let the fox be put in charge of the hen house. When the law defined appraisers as a part of the lending or real estate industries the only route was down. That is like defining doctors as a part of the pharmaceutical industry or the lawyers as a part of the insurance industry.

USPAP is great, but it is struggling to survive the pressures brought by Fannie Mae and the rest of the lending industry. It is time we took it entirely for ourselves as a matter of pride if nothing else.

Happy Thanksgiving!

Interesting that an appraiser would comment that “the entry standards are far too low”.

I can only compare the entry standards for appraisers to those of real estate salespersons. The pathetic standards for entry into the real estate brokerage business are so low it’s an embarrasement to those of us who are brokers with many years experience.

I have considered the critical nature of the appraisal in real estate sales and find, not only the entry level far higher than for that of a real estate licensse, the CE and supervised practices are far better.

Of course the comparison wouldn’t be complete without comparing the average compensation to a real estate salesperson to that of the average appraisal.

Lenn Harley

Broker

Homefinders.com

Serving home buyers in MD and VA